33 Analysts Have This To Say About Roku

Throughout the last three months, 33 analysts have evaluated Roku (NASDAQ:ROKU), offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 11 | 12 | 10 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 6 | 7 | 5 | 0 | 0 |

| 2M Ago | 2 | 1 | 0 | 0 | 0 |

| 3M Ago | 2 | 4 | 5 | 0 | 0 |

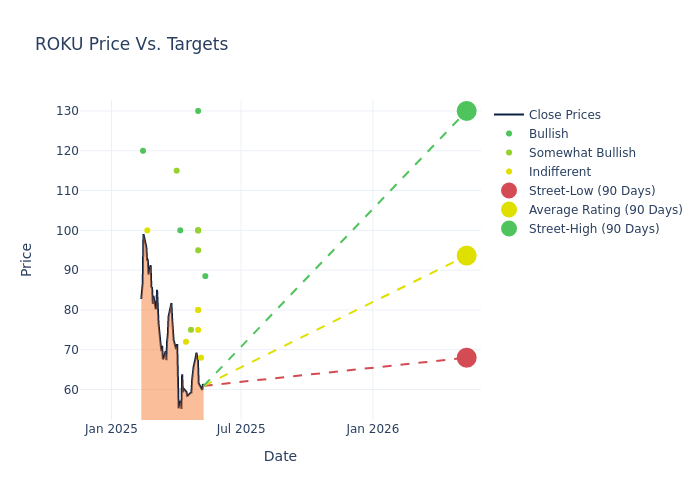

Insights from analysts' 12-month price targets are revealed, presenting an average target of $99.55, a high estimate of $130.00, and a low estimate of $68.00. This current average reflects an increase of 2.66% from the previous average price target of $96.97.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of Roku by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Laura Martin | Needham | Maintains | Buy | $88.50 | $88.50 |

| Jason Bazinet | Citigroup | Lowers | Neutral | $68.00 | $81.00 |

| Alan Gould | Loop Capital | Lowers | Hold | $80.00 | $90.00 |

| Steven Cahall | Wells Fargo | Raises | Overweight | $100.00 | $93.00 |

| Michael Morris | Guggenheim | Maintains | Buy | $100.00 | $100.00 |

| Alicia Reese | Wedbush | Maintains | Outperform | $100.00 | $100.00 |

| Daniel Kurnos | Benchmark | Maintains | Buy | $130.00 | $130.00 |

| Matthew Carletti | JMP Securities | Maintains | Market Outperform | $95.00 | $95.00 |

| Shweta Khajuria | Evercore ISI Group | Lowers | In-Line | $80.00 | $105.00 |

| Barton Crockett | Rosenblatt | Lowers | Neutral | $75.00 | $100.00 |

| Laura Martin | Needham | Maintains | Buy | $88.50 | $88.50 |

| Steven Cahall | Wells Fargo | Lowers | Overweight | $93.00 | $129.00 |

| Alicia Reese | Wedbush | Lowers | Outperform | $100.00 | $125.00 |

| Laura Martin | Needham | Maintains | Buy | $88.50 | $88.50 |

| Matthew Condon | JMP Securities | Maintains | Market Outperform | $95.00 | $95.00 |

| Cory Carpenter | JP Morgan | Lowers | Overweight | $75.00 | $115.00 |

| Daniel Kurnos | Benchmark | Maintains | Buy | $130.00 | $130.00 |

| John Hodulik | UBS | Lowers | Neutral | $72.00 | $90.00 |

| Laura Martin | Needham | Maintains | Buy | $88.50 | $88.50 |

| Hamilton Faber | Redburn Atlantic | Announces | Buy | $100.00 | - |

| Matthew Condon | Citizens Capital Markets | Maintains | Market Outperform | $115.00 | $115.00 |

| Laura Martin | Needham | Maintains | Buy | $120.00 | $120.00 |

| Matthew Condon | Citizens Capital Markets | Maintains | Market Outperform | $115.00 | $115.00 |

| Jason Bazinet | Citigroup | Raises | Neutral | $103.00 | $70.00 |

| James Heaney | Jefferies | Raises | Hold | $100.00 | $55.00 |

| John Hodulik | UBS | Raises | Neutral | $90.00 | $73.00 |

| Daniel Kurnos | Benchmark | Raises | Buy | $130.00 | $100.00 |

| Matthew Condon | JMP Securities | Raises | Market Outperform | $115.00 | $95.00 |

| Cory Carpenter | JP Morgan | Raises | Overweight | $115.00 | $92.00 |

| Ruplu Bhattacharya | B of A Securities | Raises | Buy | $120.00 | $90.00 |

| Barton Crockett | Rosenblatt | Raises | Neutral | $100.00 | $86.00 |

| Steven Cahall | Wells Fargo | Raises | Overweight | $129.00 | $74.00 |

| Barton Crockett | Rosenblatt | Maintains | Neutral | $86.00 | $86.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Roku. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Roku compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Roku's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Roku's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Roku analyst ratings.

All You Need to Know About Roku

Roku enables consumers to stream television programming. It has more than 90 million streaming households and provided 127 billion streaming hours in 2024. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku's OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku's name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

Roku: Delving into Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Positive Revenue Trend: Examining Roku's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 15.79% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Communication Services sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Roku's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -2.69%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Roku's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -1.09%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Roku's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.65%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.23, Roku adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal