Market Might Still Lack Some Conviction On Symbotic Inc. (NASDAQ:SYM) Even After 34% Share Price Boost

Symbotic Inc. (NASDAQ:SYM) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 47% in the last twelve months.

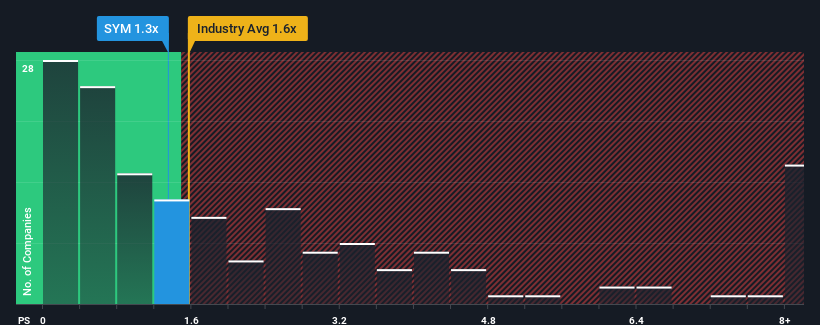

In spite of the firm bounce in price, there still wouldn't be many who think Symbotic's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in the United States' Machinery industry is similar at about 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Symbotic

What Does Symbotic's Recent Performance Look Like?

Symbotic certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on Symbotic will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Symbotic's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Symbotic's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 44%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 25% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 4.5% per year, which is noticeably less attractive.

With this information, we find it interesting that Symbotic is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Symbotic's P/S?

Symbotic appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Symbotic's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 1 warning sign for Symbotic that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal