Beyond The Numbers: 8 Analysts Discuss Regal Rexnord Stock

Analysts' ratings for Regal Rexnord (NYSE:RRX) over the last quarter vary from bullish to bearish, as provided by 8 analysts.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 5 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

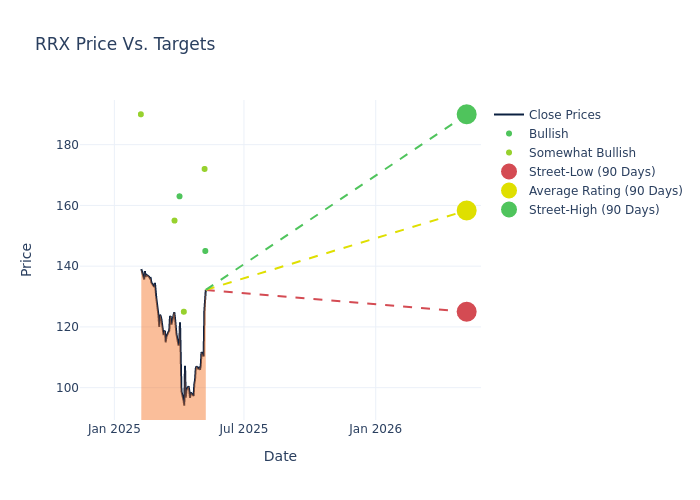

Analysts have recently evaluated Regal Rexnord and provided 12-month price targets. The average target is $150.75, accompanied by a high estimate of $176.00 and a low estimate of $110.00. A decline of 9.73% from the prior average price target is evident in the current average.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Regal Rexnord. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kyle Menges | Citigroup | Raises | Buy | $145.00 | $110.00 |

| Michael Halloran | Baird | Raises | Outperform | $172.00 | $167.00 |

| Kyle Menges | Citigroup | Lowers | Buy | $110.00 | $170.00 |

| Jeffrey Hammond | Keybanc | Lowers | Overweight | $125.00 | $180.00 |

| Joe Ritchie | Goldman Sachs | Lowers | Buy | $163.00 | $183.00 |

| Julian Mitchell | Barclays | Lowers | Overweight | $155.00 | $160.00 |

| Julian Mitchell | Barclays | Lowers | Overweight | $160.00 | $176.00 |

| Julian Mitchell | Barclays | Lowers | Overweight | $176.00 | $190.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Regal Rexnord. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Regal Rexnord compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Regal Rexnord's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Regal Rexnord's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Regal Rexnord analyst ratings.

Get to Know Regal Rexnord Better

Regal Rexnord Corp is in the engineering and manufacturing of industrial powertrain solutions, power transmission components, electric motors, electronic controls, air-moving products, and specialty electrical components and systems, serving customers around the world. The four operating segments include Commercial Systems, Industrial Systems, Climate Solutions, and Motion Control Solutions.

A Deep Dive into Regal Rexnord's Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Challenges: Regal Rexnord's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -8.37%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Regal Rexnord's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.04% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.9%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Regal Rexnord's ROA stands out, surpassing industry averages. With an impressive ROA of 0.41%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Regal Rexnord's debt-to-equity ratio surpasses industry norms, standing at 0.85. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal