2 Top Bargain Stocks Ready for a Bull Run

The S&P 500 is only down about 8% from its all-time high, as of this writing, after swiftly recovering from its recent (and brief) 19% tumble. In fact, the market rose for nine straight trading sessions, which is the first time that's happened in over 20 years.

Despite the dramatic recovery, some stocks are still trading in bargain territory. Two of these are Lyft (NASDAQ: LYFT) and Shift4 Payments (NYSE: FOUR). Right now, investors seem unenthused with this duo even though the business fundamentals are strong. And they could be just a bull run away from finally making some serious money for their shareholders.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

Concerns about Lyft are overblown

Will riders stop using services such as Lyft and Uber if auto manufacturers roll out their own autonomous taxi services? That is one of the biggest concerns holding down Lyft stock right now. When it comes to being a bargain, it trades at just 7 times its free cash flow, which is one of the cheapest stocks around.

I'll go out on a limb here by using an example from the restaurant industry. Domino's Pizza has handled its own delivery for decades, and it has its own convenient app for placing orders. And yet, the company recently partnered with both Uber and DoorDash. It's partnering with these delivery apps because it's actually boosting its own demand.

In other words, the delivery apps are successfully aggregating demand even though restaurants such as Domino's can go directly to consumers. I believe the same dynamic could hold true in the ride-hailing space. Yes, car manufacturers may develop their own autonomous services in time. Then again, it's possible, if not likely, that demand would still be aggregated on apps such as Lyft and Uber for those who don't prefer one car brand over another.

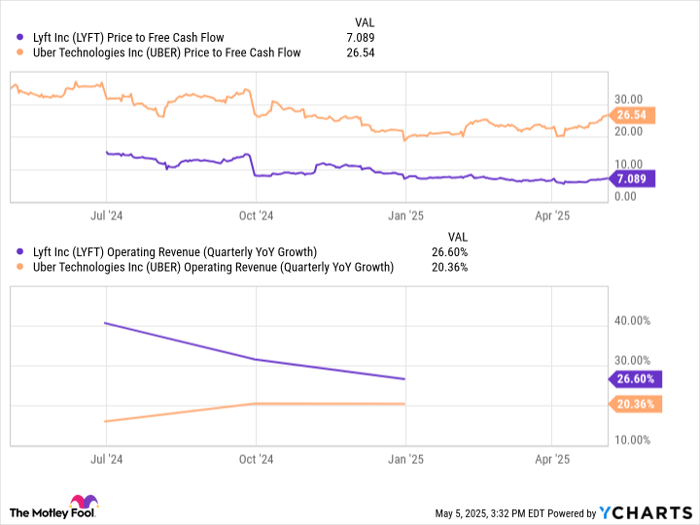

So why buy Lyft stock instead of Uber stock? For me, the answer is simple: Lyft stock is far cheaper even though it's growing faster, as seen on the chart below.

Data by YCharts.

Keep in mind that there are no autonomous taxi services today that could replace the current ride-hailing system. In other words, the fear is still hypothetical. And even once those services start rolling out, it could still take years before they start putting pressure on this space.

In short, I believe that fears are overblown. Lyft is growing by adding new active users, and it's generating a lot of free cash flow. This is a profitable growth stock worth owning today for the long haul.

Shift4 Payments performs better in an uncertain economy

Shift4 Payments stock has dropped more than 30% from its high because investors hate uncertainty. The company provides financial services to resorts, sporting complexes, and restaurants. And all of these categories face uncertain prospects in the near term because of a potentially cooling economy. Moreover, founder and CEO Jared Isaacman has stepped away from the company in hopes of leading NASA. This has dropped the stock down to a bargain valuation of just 2 times sales.

Fortunately for investors, Shift4's business hasn't skipped a beat. In the first quarter of 2025, the company's gross revenue (less network fees) was up a whopping 40% year over year, thanks in part to some promising new customer wins. Excluding network fees is common with this kind of business, but it's possible that some investors don't appreciate non-traditional metrics. In that case, it still delivered an impressive quarter for investors, with revenue up a strong 20% to $848 million.

Shift4's business is also profitable, which is a good thing. And strong financials support the company's decision to make acquisitions when it makes sense. The company recently announced its intentions to buy Global Blue, a financial services company with a focus on international travel. That's a business that could go nicely with Shift4's focus on venues, restaurants, and more. And it could support more growth.

Shift4 stock is dropping as the economy faces some headwinds. But management is quick to point out that some of its best growth has come during economic recessions.

In short, Shift4's business is doing well and earning plenty of profit. The stock is down because of economic and business uncertainties. But the company has shone during times like this in the past, and management is optimistic that history will repeat itself here.

2 stocks too good to pass up at the moment

Personally, I'm not sure where the S&P 500 is going from here -- I could make an argument either way. But I'm not trying to predict the stock market and time the peaks and the valleys. I'm trying to find good businesses to invest in for the long haul.

I believe that Lyft and Shift4 are good businesses, as evidenced by their fast growth and attractive profits. And from an investment perspective, both stocks trade at a price that looks too good to pass up.

Jon Quast has positions in Lyft and Shift4 Payments. The Motley Fool has positions in and recommends Domino's Pizza, DoorDash, Shift4 Payments, and Uber Technologies. The Motley Fool has a disclosure policy.

Wall Street Journal

Wall Street Journal