A Glimpse of RumbleON's Earnings Potential

RumbleON (NASDAQ:RMBL) is preparing to release its quarterly earnings on Wednesday, 2025-05-07. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect RumbleON to report an earnings per share (EPS) of $-0.23.

The market awaits RumbleON's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

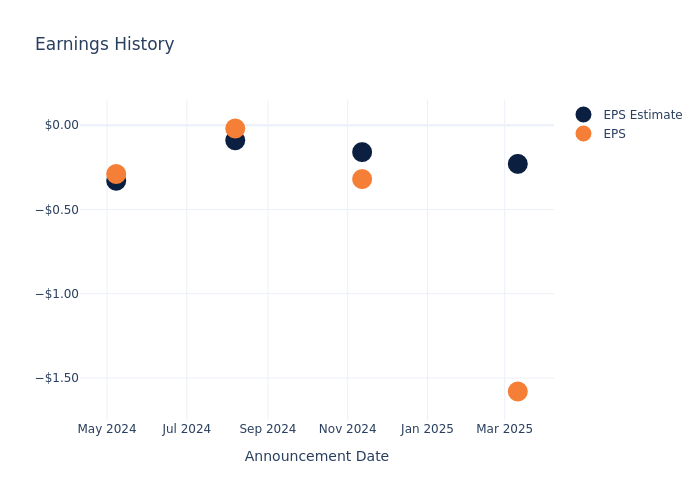

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $1.35, leading to a 5.85% increase in the share price the following trading session.

Here's a look at RumbleON's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.23 | -0.16 | -0.09 | -0.33 |

| EPS Actual | -1.58 | -0.32 | -0.02 | -0.29 |

| Price Change % | 6.0% | 4.0% | 3.0% | 13.0% |

Market Performance of RumbleON's Stock

Shares of RumbleON were trading at $2.77 as of May 05. Over the last 52-week period, shares are down 50.92%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Insights on RumbleON

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on RumbleON.

With 4 analyst ratings, RumbleON has a consensus rating of Neutral. The average one-year price target is $4.25, indicating a potential 53.43% upside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of OneWater Marine and Monro, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for OneWater Marine, with an average 1-year price target of $16.75, suggesting a potential 504.69% upside.

- Analysts currently favor an Neutral trajectory for Monro, with an average 1-year price target of $18.8, suggesting a potential 578.7% upside.

Peer Metrics Summary

The peer analysis summary outlines pivotal metrics for OneWater Marine and Monro, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| RumbleON | Neutral | -13.37% | $67.50M | -94.00% |

| OneWater Marine | Neutral | -0.98% | $110.41M | -0.10% |

| Monro | Neutral | -3.74% | $104.80M | 0.65% |

Key Takeaway:

RumbleON is at the bottom for Revenue Growth and Gross Profit, with negative percentages. It is also at the bottom for Return on Equity, with a negative percentage.

Get to Know RumbleON Better

RumbleON Inc is a USA-based online retailer that allows both consumers and dealers to Buy-Sell-Trade-Finance pre-owned motorcycles in an efficient, fast, transparent, and engaging experience. Its segments include powersports dealership group and vehicle transportation services. The powersports dealership group segment is comprised of powersports dealerships that sell new and pre-owned powersports vehicles; parts, service and accessories; and finance and inventory products for powersports vehicles sold. The vehicle transportation services segment provides nationwide transportation brokerage services between dealerships and auctions.

RumbleON's Economic Impact: An Analysis

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Challenges: RumbleON's revenue growth over 3 months faced difficulties. As of 31 December, 2024, the company experienced a decline of approximately -13.37%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: RumbleON's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -20.92%, the company may face hurdles in effective cost management.

Return on Equity (ROE): RumbleON's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -94.0%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -7.11%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: RumbleON's debt-to-equity ratio stands notably higher than the industry average, reaching 16.76. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for RumbleON visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal