Deep Dive Into Pinterest Stock: Analyst Perspectives (29 Ratings)

In the latest quarter, 29 analysts provided ratings for Pinterest (NYSE:PINS), showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 13 | 10 | 6 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 6 | 1 | 3 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 5 | 7 | 3 | 0 | 0 |

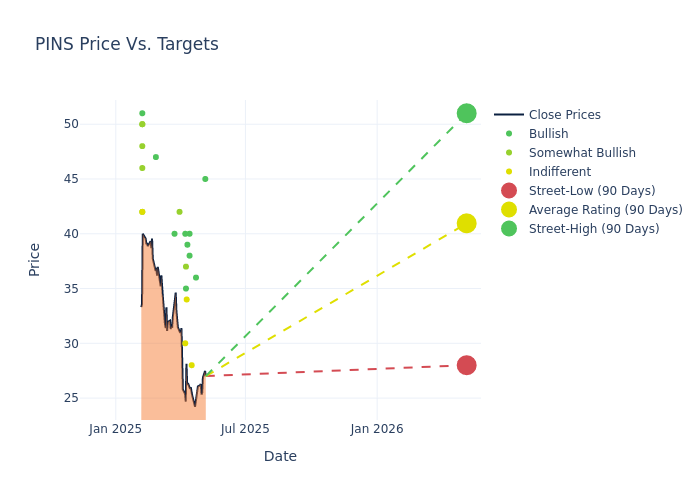

Insights from analysts' 12-month price targets are revealed, presenting an average target of $42.28, a high estimate of $55.00, and a low estimate of $28.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 1.35%.

Investigating Analyst Ratings: An Elaborate Study

The standing of Pinterest among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Zgutowicz | Benchmark | Lowers | Buy | $45.00 | $55.00 |

| Mark Kelley | Stifel | Lowers | Buy | $36.00 | $50.00 |

| Brian Nowak | Morgan Stanley | Lowers | Equal-Weight | $28.00 | $42.00 |

| Ronald Josey | Citigroup | Lowers | Buy | $38.00 | $47.00 |

| Eric Sheridan | Goldman Sachs | Lowers | Buy | $40.00 | $47.00 |

| Lloyd Walmsley | UBS | Lowers | Buy | $39.00 | $50.00 |

| Thomas Champion | Piper Sandler | Lowers | Neutral | $34.00 | $41.00 |

| Justin Patterson | Keybanc | Lowers | Overweight | $37.00 | $41.00 |

| Justin Post | B of A Securities | Lowers | Buy | $35.00 | $46.00 |

| John Blackledge | TD Cowen | Lowers | Buy | $40.00 | $46.00 |

| Doug Anmuth | JP Morgan | Lowers | Neutral | $30.00 | $42.00 |

| Ken Gawrelski | Wells Fargo | Lowers | Overweight | $42.00 | $47.00 |

| Michael Morris | Guggenheim | Raises | Buy | $40.00 | $39.00 |

| Jason Celino | Keybanc | Lowers | Overweight | $41.00 | $46.00 |

| Rob Sanderson | Loop Capital | Raises | Buy | $47.00 | $39.00 |

| Ross Sandler | Barclays | Raises | Equal-Weight | $42.00 | $36.00 |

| Brad Erickson | RBC Capital | Raises | Outperform | $50.00 | $48.00 |

| Scott Devitt | Wedbush | Raises | Outperform | $46.00 | $38.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Raises | Overweight | $48.00 | $36.00 |

| Mark Zgutowicz | Benchmark | Maintains | Buy | $55.00 | $55.00 |

| Eric Sheridan | Goldman Sachs | Raises | Buy | $47.00 | $42.00 |

| Jason Helfstein | Oppenheimer | Raises | Outperform | $50.00 | $40.00 |

| Aaron Kessler | Raymond James | Raises | Outperform | $42.00 | $34.00 |

| Mark Kelley | Stifel | Raises | Buy | $50.00 | $45.00 |

| Michael Morris | Guggenheim | Raises | Neutral | $39.00 | $33.00 |

| Justin Patterson | Keybanc | Raises | Overweight | $46.00 | $37.00 |

| Ken Gawrelski | Wells Fargo | Raises | Overweight | $47.00 | $39.00 |

| Thomas Champion | Piper Sandler | Raises | Neutral | $41.00 | $36.00 |

| Barton Crockett | Rosenblatt | Raises | Buy | $51.00 | $46.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Pinterest. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Pinterest compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Pinterest's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Pinterest's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Pinterest analyst ratings.

About Pinterest

Pinterest is a social media platform with a focus on product and idea discovery. Pinterest users, or pinners, can leverage the platform as they go about gathering ideas on topics such as home improvement, fashion, cooking, and travel. The company has more than 500 million monthly active users, two thirds of whom are female. Pinterest generates revenue by selling digital ads on its platform. While the platform's user base spans the globe, the vast majority of its revenue stems from ads shown to North American users.

Pinterest: A Financial Overview

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Pinterest displayed positive results in 3M. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 17.62%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: Pinterest's net margin is impressive, surpassing industry averages. With a net margin of 160.08%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Pinterest's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 48.33%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 41.83%, the company showcases effective utilization of assets.

Debt Management: Pinterest's debt-to-equity ratio is below the industry average at 0.04, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal