CBRE Group (NYSE:CBRE) Engaged By Six Flags To Market Maryland Property For Redevelopment

The closure of Six Flags America and Hurricane Harbor, with CBRE Group (NYSE:CBRE) managing the sale, was prominent news last week. CBRE's modest price move coincided with the broader market's rise, aided by positive employment data and potential tariff talks between the U.S. and China. While the closure announcement added weight to CBRE's upward movement, the company's performance aligned with the S&P 500’s broader rally. This wider market uplift was driven by strong earnings reports and a favorable economic outlook, putting the S&P 500 on track for its longest winning streak since 2004.

Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

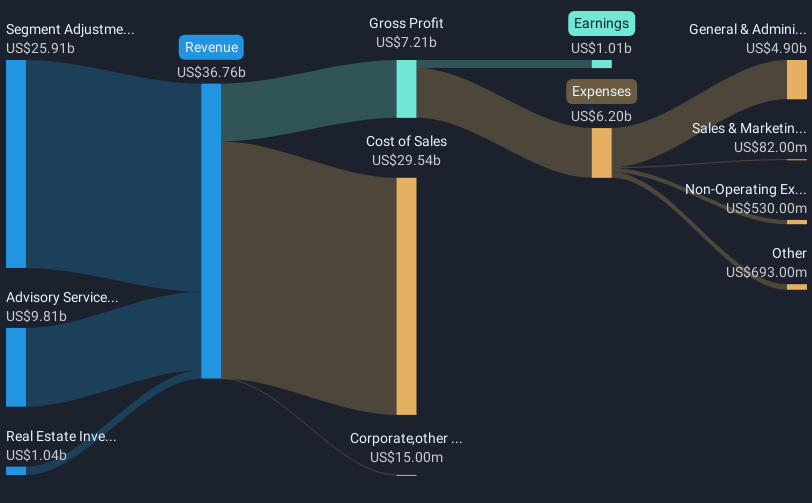

The recent closure of Six Flags America and Hurricane Harbor, managed by CBRE Group, has potential ramifications for the company's broader narrative of resilience and growth through strategic realignment and acquisitions. While the current boost in CBRE's share price aligns with positive economic indicators, it should be considered within the context of its long-term performance. Over the past five years, CBRE's total return, including share price appreciation and dividends, reached 202.08%, showcasing robust growth compared to the 1% growth of its earnings over the past year.

In contrast to CBRE's strong five-year performance, its earnings growth over the past year did not outperform the US Real Estate industry, which grew 3.8%. The market has responded favorably to CBRE's redefined focus on resilient businesses, allowing it to withstand economic uncertainties but presenting challenges such as tariff-related pressures that could affect revenue and earnings forecasts. With shares currently priced at US$121.75, the close proximity to the analyst price target of US$141.92 suggests a modest upside potential, yet analysts remain divided, with price expectations ranging from US$112 to US$163.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal