Kohl's (NYSE:KSS) Fires CEO Ashley Buchanan In Policy Violation Shake-Up

Kohl's (NYSE:KSS) is undergoing significant leadership changes with the dismissal of CEO Ashley Buchanan due to policy violations, leading to Michael Bender's interim appointment. Despite these upheavals, Kohl's shares saw a 2.56% rise last week, aligning with broader market movements as the Dow and S&P 500 surged, bolstered by strong jobs data and potential U.S.-China tariff talks. The retail sector experienced a favorable climate from overall positive market sentiment. While executive changes might add internal pressure, they coincided with a period of general optimism across equity markets, making it a part of the week's positive performance trend.

We've identified 5 risks for Kohl's (1 shouldn't be ignored) that you should be aware of.

The recent leadership changes at Kohl's—specifically the dismissal of CEO Ashley Buchanan and the appointment of Michael Bender—pose the potential to influence the company's refocusing on core categories and its omnichannel strategy. These shifts could impact revenue and earnings projections by altering operational strategies, possibly affecting the company's efforts to regain customer loyalty and market share. Amid these changes, Kohl's saw a short-term share price increase of 2.56% last week, aligning with stronger market trends, though the longer-term picture tells a different story.

Over the past five years, Kohl's shareholders have experienced a total return, including dividends, of 46.97%, highlighting significant challenges and underperformance relative to broader market indices. Compared to the US Multiline Retail industry, which returned 5.9% over the past year, Kohl's has lagged considerably, further emphasizing its struggle to maintain competitive footing. Over the past year, Kohl's also underperformed the US Market, which delivered a return of 9.5%.

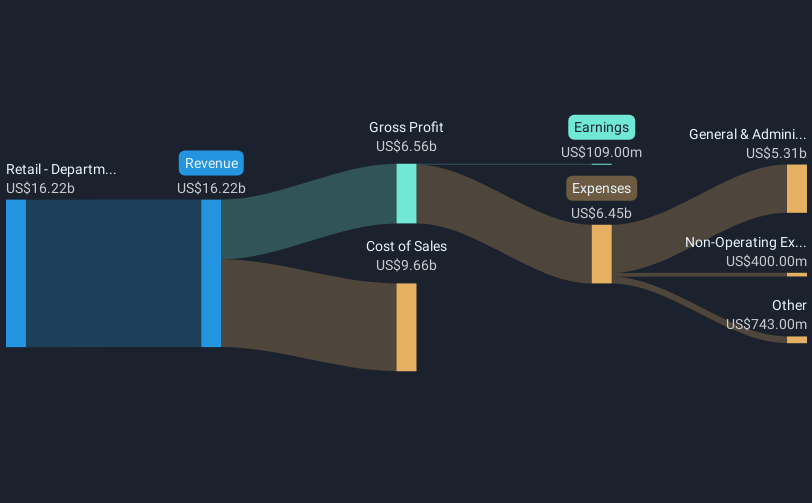

The revenue and earnings forecasts may need recalibration in light of the recent executive changes, as Kohl's aims for a more streamlined merchandise and customer engagement strategy. While the share price is currently at US$6.82, the analyst consensus price target stands at US$9.66, representing a potential 29.4% increase if the forecasts align with the predicted company performance improvements. Investors will need to consider whether the leadership shift will effectively translate into the expected operational efficiencies and profit margin expansion.

Learn about Kohl's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal