TSX Penny Stocks Under CA$200M Market Cap To Consider

The Canadian market has shown resilience, with the TSX only 4% off its record high, bolstered by a strong materials sector. In this context of cautious optimism and potential volatility, investors may find value in exploring smaller companies that offer growth opportunities at lower price points. Penny stocks, while a somewhat outdated term, still highlight these smaller or newer companies that can provide both affordability and potential upside when backed by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$73.84M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.62 | CA$69.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.63 | CA$425.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.11 | CA$575.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$287.16M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$530.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.61 | CA$129.53M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.39 | CA$92.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$14.04M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.23 | CA$47.27M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 926 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Tree Island Steel (TSX:TSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tree Island Steel Ltd. manufactures and sells steel wire and fabricated steel wire products across Canada, the United States, and internationally, with a market cap of CA$68.93 million.

Operations: The company's revenue is primarily derived from the United States (CA$121.96 million), followed by Canada (CA$81.59 million) and international markets (CA$3.44 million).

Market Cap: CA$68.93M

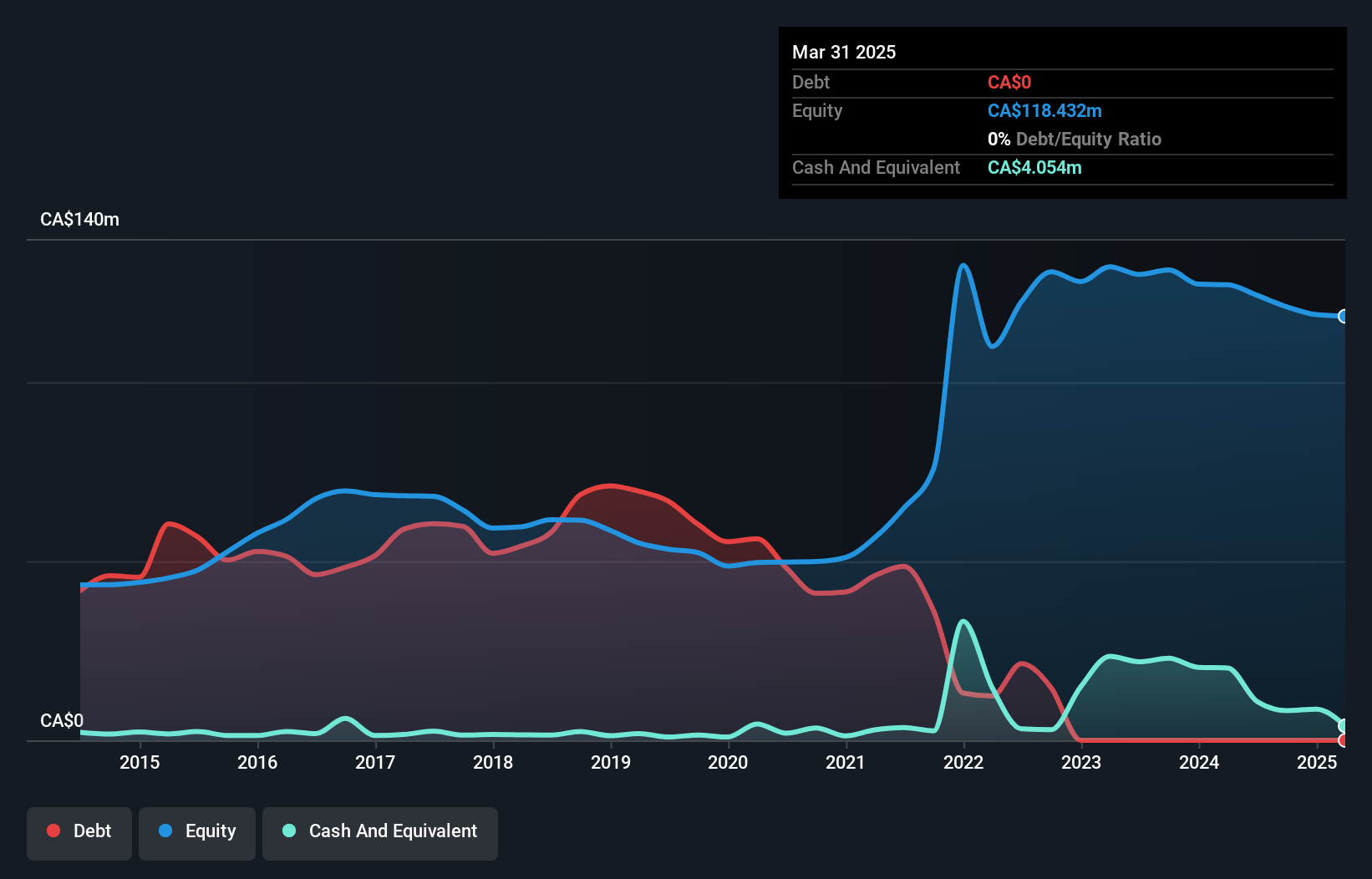

Tree Island Steel Ltd., with a market cap of CA$68.93 million, faces challenges as it reported a net loss of CA$3.91 million for 2024, reversing from a profit the previous year. Despite being debt-free and having sufficient short-term assets to cover liabilities, the company remains unprofitable with declining earnings over five years at an annual rate of 1.7%. The dividend was halved to $0.015 per share due to insufficient coverage by earnings or cash flow. While its board is experienced, management tenure data is lacking, adding uncertainty in leadership stability amidst financial struggles.

- Jump into the full analysis health report here for a deeper understanding of Tree Island Steel.

- Gain insights into Tree Island Steel's historical outcomes by reviewing our past performance report.

AI Artificial Intelligence Ventures (TSXV:AIVC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AI Artificial Intelligence Ventures Inc., previously ESG Global Impact Capital Inc., is a venture capital and private equity firm focused on seed/startups, early-stage, growth capital, debt, and equity investing with a market cap of CA$12.81 million.

Operations: AI Artificial Intelligence Ventures Inc. does not currently have classified revenue segments to report.

Market Cap: CA$12.81M

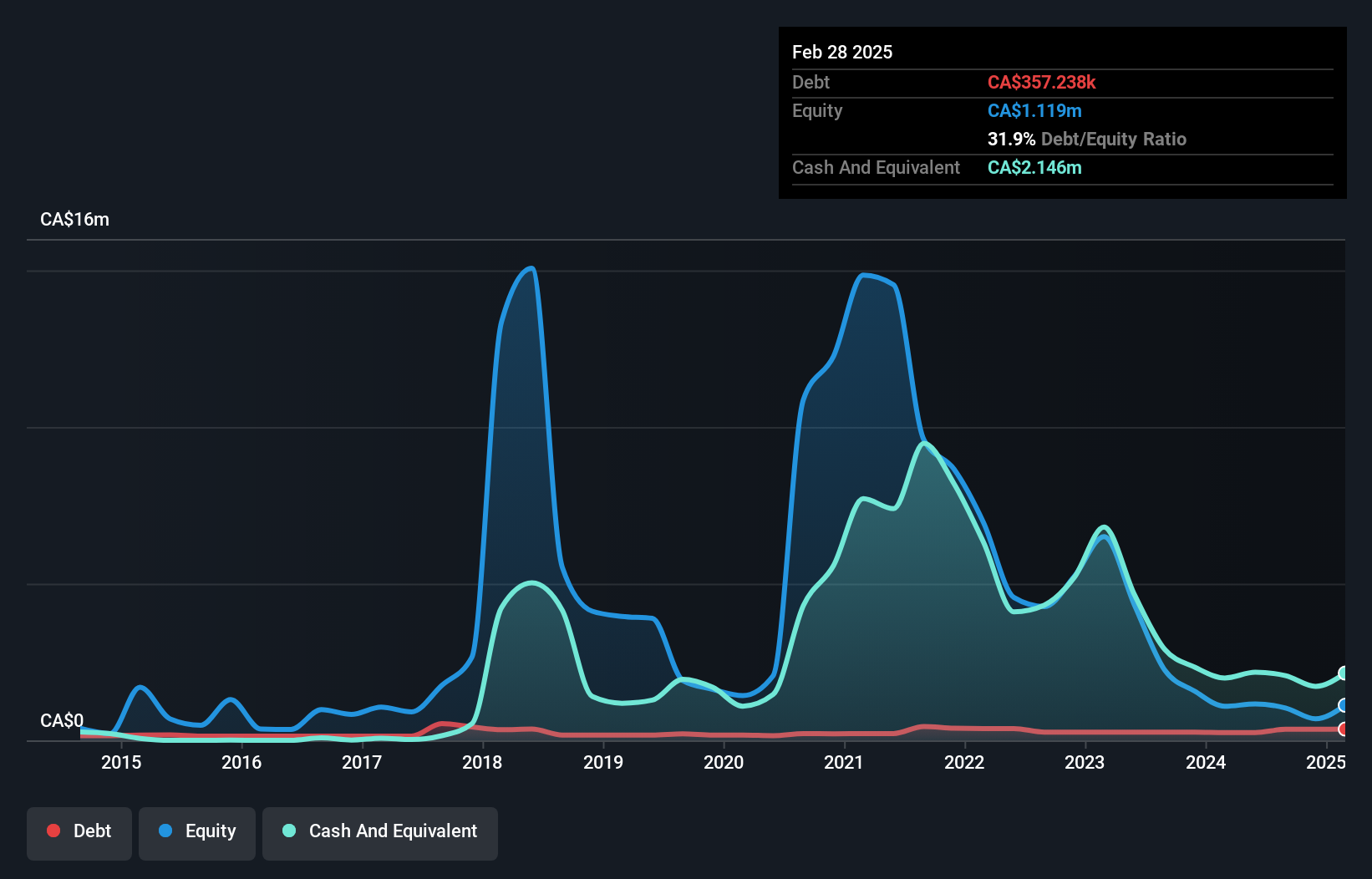

AI Artificial Intelligence Ventures Inc., with a market cap of CA$12.81 million, is pre-revenue and faces challenges with declining earnings over the past five years at 19.6% annually. Despite this, its short-term assets of CA$2.1 million cover liabilities of CA$1.4 million, and it has no long-term liabilities, positioning it to manage immediate financial obligations effectively. The company benefits from an experienced management team and board, though its share price remains highly volatile over recent months. It maintains a cash runway exceeding three years if historical free cash flow growth continues, providing some financial stability amidst current unprofitability.

- Take a closer look at AI Artificial Intelligence Ventures' potential here in our financial health report.

- Understand AI Artificial Intelligence Ventures' track record by examining our performance history report.

Rock Tech Lithium (TSXV:RCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rock Tech Lithium Inc. is involved in the exploration and development of lithium properties, with a market cap of CA$108.10 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$108.1M

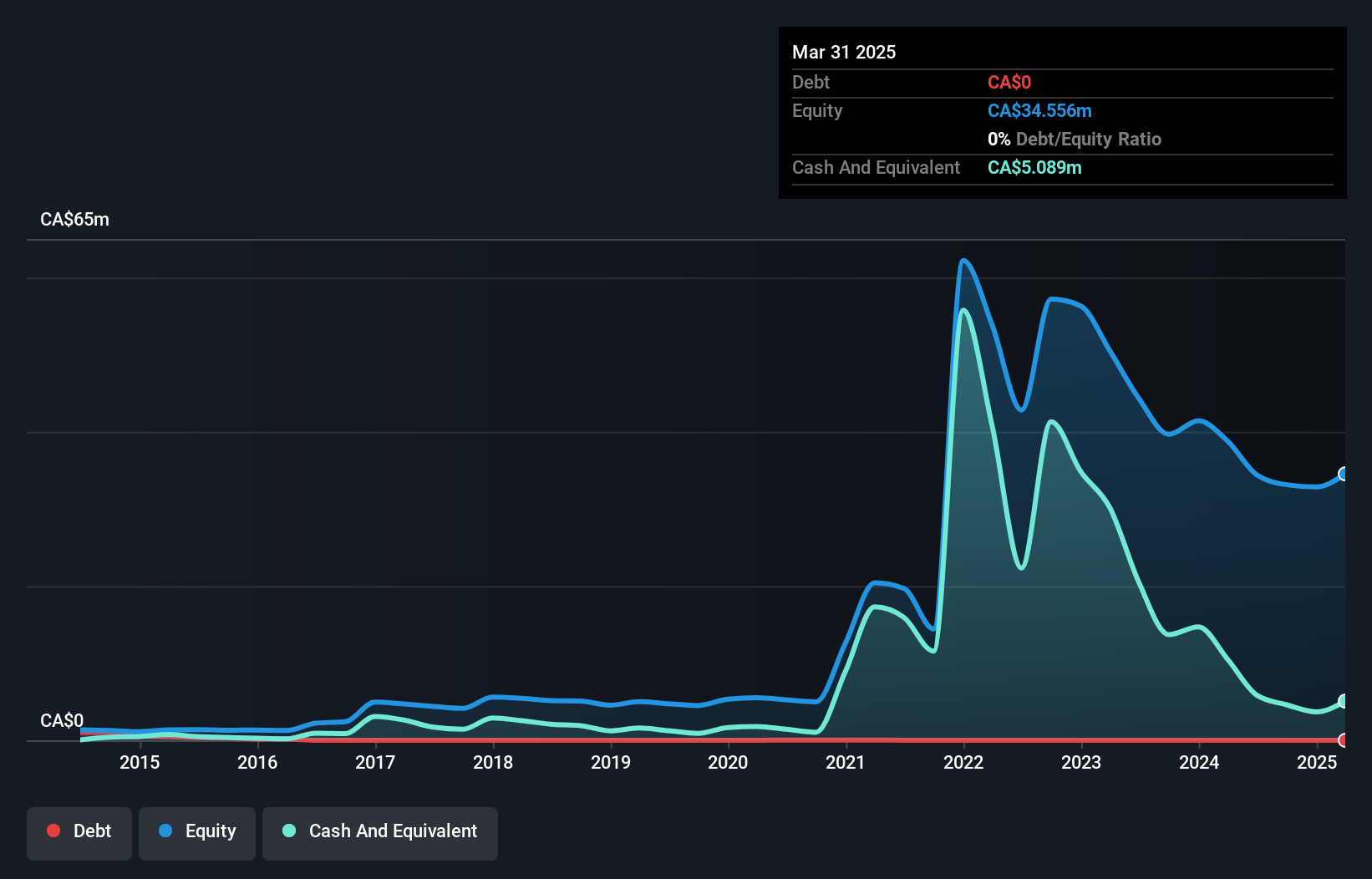

Rock Tech Lithium Inc., with a market cap of CA$108.10 million, is pre-revenue and unprofitable, experiencing increasing losses over the past five years. Despite this, its short-term assets of CA$4.4 million exceed both short-term and long-term liabilities, offering some financial cushion. Recent capital raises through private placements have bolstered its cash position slightly but only provide a limited runway. The company has undergone board changes with the addition of Dr. Beate Degen, bringing strategic expertise to its governance team as it navigates challenges in achieving profitability amidst declining earnings forecasts over the next three years.

- Unlock comprehensive insights into our analysis of Rock Tech Lithium stock in this financial health report.

- Gain insights into Rock Tech Lithium's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Jump into our full catalog of 926 TSX Penny Stocks here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal