10 Analysts Have This To Say About Mid-America Apartment

In the last three months, 10 analysts have published ratings on Mid-America Apartment (NYSE:MAA), offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 3 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 3 | 0 | 0 |

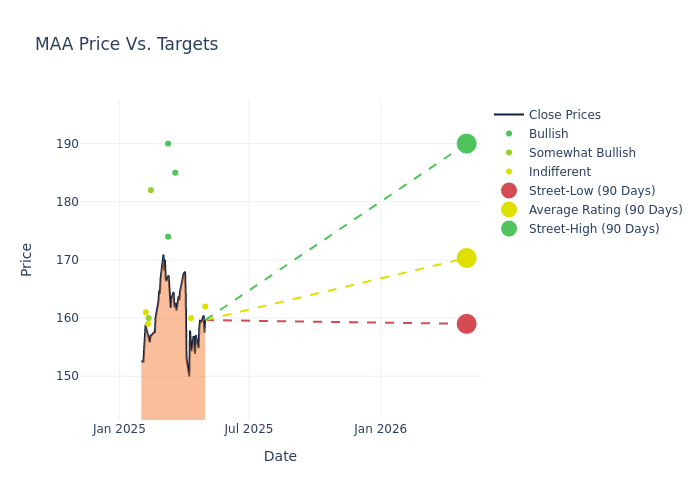

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $169.6, with a high estimate of $190.00 and a low estimate of $159.00. Surpassing the previous average price target of $160.80, the current average has increased by 5.47%.

Decoding Analyst Ratings: A Detailed Look

In examining recent analyst actions, we gain insights into how financial experts perceive Mid-America Apartment. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Wesley Golladay | Baird | Raises | Neutral | $162.00 | $161.00 |

| Richard Hightower | Barclays | Lowers | Equal-Weight | $160.00 | $163.00 |

| Buck Horne | Raymond James | Raises | Strong Buy | $185.00 | $180.00 |

| Michael Lewis | Truist Securities | Raises | Buy | $174.00 | $158.00 |

| Linda Tsai | Jefferies | Raises | Buy | $190.00 | $148.00 |

| Richard Hightower | Barclays | Raises | Equal-Weight | $163.00 | $152.00 |

| Nicholas Yulico | Scotiabank | Raises | Sector Outperform | $182.00 | $173.00 |

| Aaron Hecht | JMP Securities | Maintains | Market Outperform | $160.00 | $160.00 |

| Steve Sakwa | Evercore ISI Group | Raises | In-Line | $159.00 | $155.00 |

| Brad Heffern | RBC Capital | Raises | Sector Perform | $161.00 | $158.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Mid-America Apartment. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Mid-America Apartment compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Mid-America Apartment's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Mid-America Apartment's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Mid-America Apartment analyst ratings.

Discovering Mid-America Apartment: A Closer Look

Mid-America Apartment Communities Inc or MAA, is a real estate investment trust engaged in the acquisition, operation, and development of multifamily apartment communities located in the southeastern and southwestern United States. The company operates two reportable segments; Same Store includes communities that the Company has owned and have been stabilized for at least a full 12 months as of the first day of the calendar year and Non-Same Store and Other includes recently acquired communities, communities being developed or in lease-up, communities that have been disposed of or identified for disposition, communities that have experienced a casualty loss and stabilized communities that do not meet the requirements to be Same Store communities.

Mid-America Apartment: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Mid-America Apartment displayed positive results in 3M. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 1.4%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 30.16%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Mid-America Apartment's ROE excels beyond industry benchmarks, reaching 2.78%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Mid-America Apartment's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.41% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Mid-America Apartment's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.84.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal