Li Auto (NasdaqGS:LI) Partners With Celanese To Enhance In-Cabin Air Quality

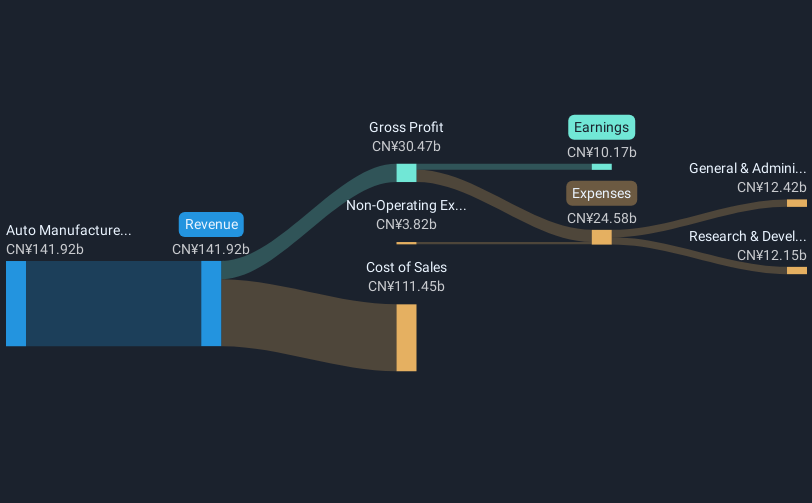

Li Auto (NasdaqGS:LI) achieved a 4% gain over the last quarter, coinciding with significant strategic initiatives, including a joint venture with Celanese Corporation to launch Hostaform® POM XAP® 3, an ultra-low emission material designed to enhance in-cabin air quality. During this period, the company reported increased vehicle deliveries, improving 27% in March, although earnings showed a dip with net income and EPS declining compared to the previous year. Amid market fluctuations, including declines in major indices and economic contraction concerns, these developments added a positive weight to Li Auto's share price, aligning with trends of robust quarterly performances seen across various sectors.

The recent initiatives by Li Auto, including its joint venture with Celanese Corporation to introduce Hostaform POM XAP 3, are poised to influence the company's revenue and earnings forecasts. The enhanced in-cabin air quality offered by this ultra-low emission material could see Li Auto differentiate its offerings, potentially attracting more consumers and boosting sales. However, while the company's commitment to innovation is clear, the dip in net income and EPS highlights the challenges faced in terms of profitability, particularly amidst increasing investments in autonomous driving and AI.

Over the past three years, Li Auto's total shareholder return, inclusive of share price changes and dividends, was 5.41%. This longer-term performance provides context to the company's current trajectory, heavily influenced by its technological and strategic upgrades. In the last year, when comparing with the US Auto industry's average return of 45.7%, Li Auto underperformed, reflecting significant competitive and market pressures despite its technological advances.

Despite a current share price of US$23.78, the consensus analyst price target is US$33.58, representing a potential increase of 29.1%. This target considers anticipated revenue growth and improved profit margins, should the company's strategic initiatives bear fruit. Investors will need to closely watch whether these efforts can translate into sustainable financial growth to bridge the current gap between the price and the forecasted target.

Assess Li Auto's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal