PayPal Says 'Buy Now, Pay Later' Users Spend 33% More, Make 17% More Transactions—Pushes For Global Rollout

PayPal Holdings Inc. (NASDAQ:PYPL) is seeing strong momentum with its "Buy Now, Pay Later" services, with significantly higher user engagement and larger transaction sizes, as it expands the offering globally.

What Happened: During its first quarter earnings on Tuesday, PayPal highlighted key developments in its Buy Now, Pay Later (BNPL) service, a short-term financing option that lets consumers defer payments on purchases, starting with a 0% APR, and no late fees.

BNPL users spend 33% more per transaction than PayPal's overall average of $69.53, the company said. They also complete 17% more transactions than the average of 59.4 per active account over the past 12 months.

Although PayPal launched its BNPL service in 2020, the company credits recent gains to its improved pay sheet that clearly showcases its full range of payment options. The service has also received greater visibility through marketing campaigns, including one featuring actor Will Ferrell.

Despite inherent credit risks tied to BNPL offerings, PayPal CFO Jamie Miller has said that charge-off rates remain stable and are improving. “In particular with respect to the consumer portfolios, we've actually seen delinquencies over the last 30 days improve,” Miller said on the earnings call.

The company’s CEO, Alex Chriss, considers BNPL a key growth lever going forward, with plans for an international rollout this year.

“We will continue to lean into BNPL throughout this year with targeted consumer awareness campaigns in the U.K. and Germany and continued investment in other priority global markets including Australia, France, Italy, and Spain,” Chriss said on the call.

Why It Matters: The BNPL market has surged in recent years, with the market expected to touch $1 trillion by 2027, led by PayPal, and its peers such as Affirm Holdings Inc. (NASDAQ:AFRM), Klarna, and AfterPay, which is now owned by Block Inc. (NYSE:XYZ).

While analysts have cautioned against rising BNPL debt and overindulgence by consumers in the past, the company’s steady charge-off rates and low delinquencies have dismissed these concerns.

Price Action: PayPal stock was up 2.14% on Tuesday, but is down 0.26% after-hours, following the company’s first quarter earnings.

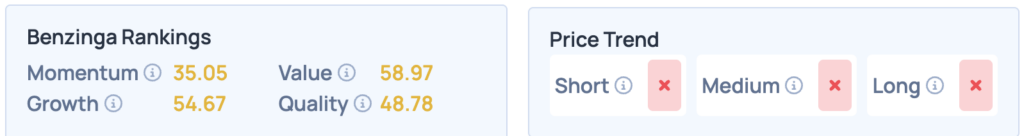

PayPal doesn’t fare too well on Benzinga’s Edge Stock Rankings, with low scores across the board, and unfavorable price trends in the short, medium, and long term. How does it compare with peers such as Affirm and Block? Sign up for Benzinga Edge to find out.

Photo Courtesy: BigTunaOnline On Shutterstock.com

Wall Street Journal

Wall Street Journal