6 Analysts Assess Victory Capital Holdings: What You Need To Know

Victory Capital Holdings (NASDAQ:VCTR) has been analyzed by 6 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 2 | 0 | 0 |

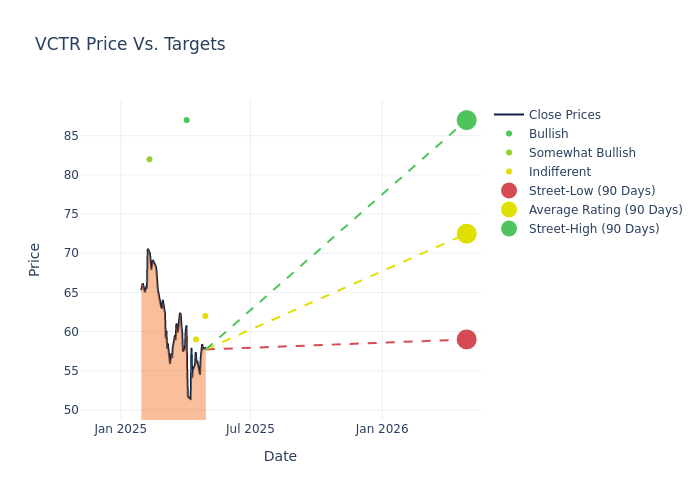

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $72.33, a high estimate of $87.00, and a low estimate of $59.00. A 0.92% drop is evident in the current average compared to the previous average price target of $73.00.

Investigating Analyst Ratings: An Elaborate Study

The standing of Victory Capital Holdings among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kenneth Worthington | JP Morgan | Lowers | Neutral | $62.00 | $69.00 |

| Benjamin Budish | Barclays | Lowers | Equal-Weight | $59.00 | $75.00 |

| Craig Siegenthaler | B of A Securities | Lowers | Buy | $87.00 | $89.00 |

| Kenneth Worthington | JP Morgan | Raises | Neutral | $69.00 | $62.00 |

| Etienne Ricard | BMO Capital | Raises | Outperform | $82.00 | $73.00 |

| Benjamin Budish | Barclays | Raises | Equal-Weight | $75.00 | $70.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Victory Capital Holdings. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Victory Capital Holdings compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Victory Capital Holdings's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Victory Capital Holdings's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Victory Capital Holdings analyst ratings.

Get to Know Victory Capital Holdings Better

Victory Capital Holdings Inc is an independent investment management firm. The company operates its business through franchises and solutions platform. It provides centralized distribution, marketing, and operations infrastructure to the company's franchises and solutions platform. The company operates through one business segment that is Investment management services and products to institutional, intermediary, retirement platforms, and individual investors. The franchises and solutions platform manages a variety of investment strategies for its customers. It derives majority of its revenues from asset-based fees from investment management products and services to individuals and institutions.

Victory Capital Holdings: Delving into Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Victory Capital Holdings displayed positive results in 3M. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 12.91%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Victory Capital Holdings's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 33.11%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Victory Capital Holdings's ROE stands out, surpassing industry averages. With an impressive ROE of 6.7%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Victory Capital Holdings's ROA excels beyond industry benchmarks, reaching 2.98%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.86, caution is advised due to increased financial risk.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal