AbbVie (NYSE:ABBV) Receives FDA Approval For RINVOQ In Treating Giant Cell Arteritis

AbbVie (NYSE:ABBV) recently secured FDA approval for RINVOQ to treat giant cell arteritis, which alongside a biologics license application for TrenibotE, underscored the company's focus on innovation. Despite a 13% rise in its share price over the past week, AbbVie's gains were in line with the broader market's 7% climb, suggesting these product developments and positive sales growth added weight to the general upward momentum. Meanwhile, the broader market's reaction to strong earnings reports and tariff discussions may have further influenced this combined positive trajectory in the stock's performance.

AbbVie has 5 weaknesses we think you should know about.

The recent approval of RINVOQ for treating giant cell arteritis could substantially influence AbbVie's revenue trajectory as it opens new market opportunities. This aligns with AbbVie's robust plans in advancing treatments such as Skyrizi and their ongoing focus on R&D. Over the past five years, AbbVie's total return—combining share price and dividends—was 188.37%, illustrating significant long-term gains. While the broader market has seen a 7.7% increase over the past year, AbbVie's performance outpaced the US Biotechs industry, which experienced a 4.2% decline, demonstrating relative resilience amidst sector headwinds.

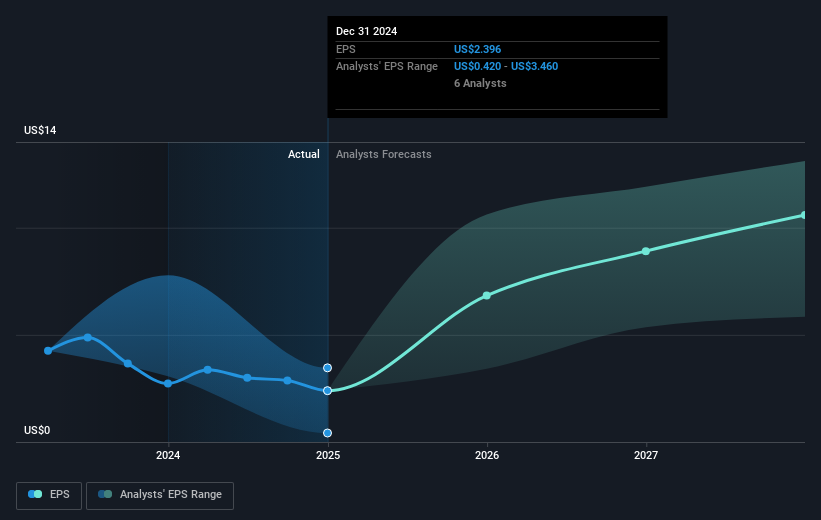

In the short term, AbbVie's recent share price movements align closely with market trends, reflecting positive market sentiment assisted by the FDA approval. If expectations surrounding revenue growth with Skyrizi and RINVOQ materialize, this could bolster future earnings estimates. Analysts suggest a revenue growth of 6.8% annually over the next three years, with an anticipated increase in profit margins. The current share price of US$173.78 shows a discount to the consensus price target of US$210.01, indicating potential upside based on analysts' expectations. However, predicting such outcomes requires careful consideration of market and competitive dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal