Mastercard (NYSE:MA) Launches Agentic Payments And Expands Cross-Border Solutions

Mastercard (NYSE:MA) saw a 5% increase in its share price over the past week, coinciding with recent announcements of innovative programs and strategic partnerships. The launch of Mastercard Agent Pay, which integrates AI to enhance payment experiences, and the expansion of stablecoin payment capabilities demonstrate the company's commitment to embracing cutting-edge technology and fostering broad consumer adoption. Additionally, Mastercard's expanded partnership with Corpay enhances corporate cross-border payment solutions. While these developments align with the company's growth, the rise in Mastercard’s stock reflects broader market trends, with key indices experiencing gains driven by strong earnings reports and positive sentiment around potential tariff adjustments.

Mastercard has 1 possible red flag we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mastercard's recent announcements, including the launch of Mastercard Agent Pay and the expansion of stablecoin payment capabilities, reinforce the company's focus on expanding its technological foothold. These initiatives align with Mastercard's growth strategy, which emphasizes global partnerships and emerging technologies to drive future expansion. Over the past five years, Mastercard has delivered a total shareholder return of 104.17%, reflecting strong long-term performance. In contrast, over the past year, Mastercard did not outperform the US Diversified Financial industry, which saw a 20.8% return.

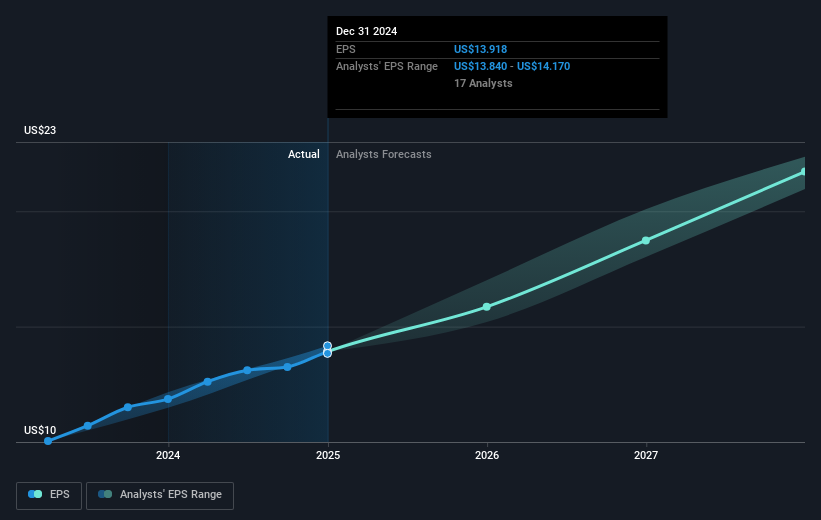

The introduction of AI integration and enhanced payment solutions is expected to support revenue and earnings growth by attracting more users and increasing transaction volume. Mastercard's revenue for the future is anticipated to grow at 12.1% annually, while earnings are projected to reach US$18.9 billion by April 2028. The current share price rise falls in line with positive sentiment but remains below the analyst consensus price target of US$613.01, offering a potential upside of 14%. As analysts predict, Mastercard's PE ratio needs to decrease to 34.1x by 2028 from its current level, which is significantly higher than the industry average. This underscores the company's premium valuation compared to its peers and the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal