Phillips 66 (NYSE:PSX) Reports 67% Shareholder Return And US$14 Billion Return To Investors

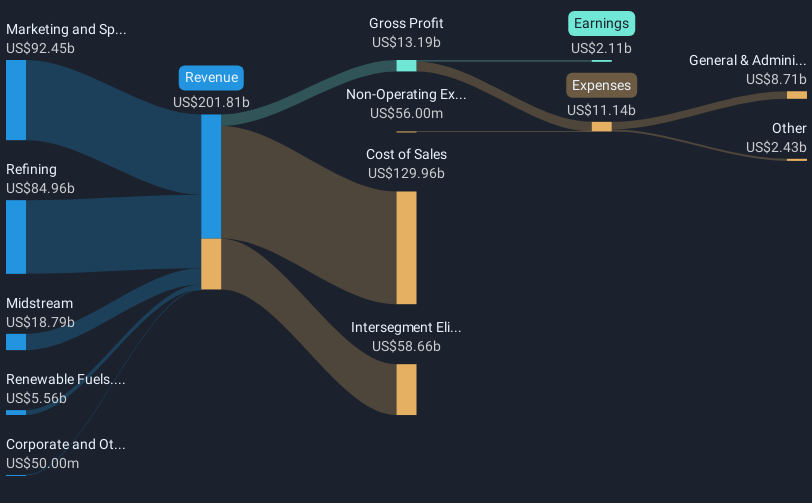

Phillips 66 (NYSE:PSX) saw its stock price rise by 9% over the last week, likely buoyed by the company's recent investor presentation that underscored strong past performance with total shareholder returns of 67% since CEO Mark Lashier's leadership began in 2022. While the broader market was up 7% over the same period, Phillips 66's proactive communication with stakeholders, strategic asset management, and significant capital return initiatives of over $14 billion might have provided additional confidence to investors. This momentum occurred amid a favorable market environment where major indices, such as the S&P 500, continued to extend their winning streaks.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Phillips 66's recent investor presentation has likely instilled renewed confidence among investors, reflected in a 9% stock price increase over the past week. This uptick aligns with its total shareholder return of 77.56% over the last five years, signaling strong long-term performance. However, the company's one-year return shows underperformance compared to the overall market, which grew by 7.7%, and the US Oil and Gas industry, which experienced a decline of 9.9% in the same timeframe. This disparity highlights potential challenges facing Phillips 66 amidst broader industry conditions.

Looking forward, the recent surge in stock price may influence revenue and earnings forecasts. The company's midstream expansion and mega-projects in the Chemicals segment are anticipated to bolster revenue and earnings growth, yet analysts expect revenues to decrease by 3.8% annually over the next three years. The price target of US$129.18 suggests a potential rise from the current share price of US$100.9, indicating strong investor expectations. As Phillips 66 pursues its portfolio optimization strategy and strategic investments, how these actions align with revenue and earnings forecasts will be crucial for sustaining its market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal