Teledyne Technologies (NYSE:TDY) Appoints George C. Bobb III As New CEO And President

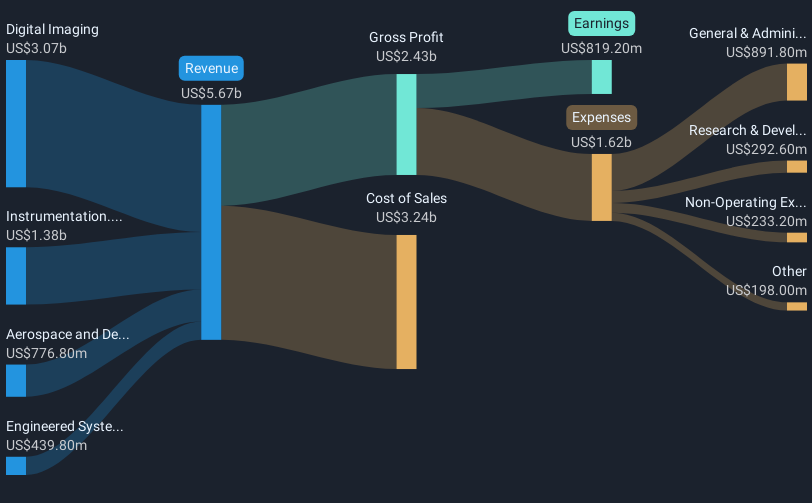

Teledyne Technologies (NYSE:TDY) recently experienced a transition in leadership with the appointment of George C. Bobb III as President and CEO, succeeding Edwin Roks, who will stay as an advisor until August. This change indicates a stable executive handover, complementing the recent approval of governance amendments at the company's annual meeting. Additionally, Teledyne reported promising Q1 earnings, with increased revenues and provided optimistic future guidance. Despite a 7.1% market uptick, the company's 2% rise aligns with broader positive trends in major indexes, bolstered by investor confidence following strong earnings and upcoming economic reports.

The recent change in leadership at Teledyne Technologies, with George C. Bobb III taking over as President and CEO, may strengthen investor confidence in the company's future direction. This executive transition aligns with recent governance amendments and follows promising Q1 earnings that highlighted increased revenues. Over the past five years, Teledyne's total return, including share price and dividends, was 45.63%. This long-term growth provides a solid foundation, although recent performance has lagged behind a broader market 7.1% uptick over one year.

Projected synergies from the Qioptiq acquisition and the strategic focus on space and defense programs could positively influence revenue and earnings forecasts. These developments may cushion the company against potential economic slowdowns and tariff challenges. The analysts' consensus price target of US$562.83 is approximately 18.1% higher than the current share price of US$461.1, indicating potential upside if growth assumptions materialize. Investors should consider how these developments and forecasts align with their own assessments of Teledyne's market position and future prospects.

Learn about Teledyne Technologies' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal