Brown & Brown (NYSE:BRO) Reports US$1,404 Million Revenue, Declares US$0.15 Dividend

Brown & Brown (NYSE:BRO) recently affirmed its quarterly cash dividend of $0.15 per share and announced robust earnings growth for Q1 2025, with revenue climbing to $1,404 million. This financial performance aligns with market trends, as major indices rose, aided by positive earnings reports despite tariff concerns. The company's 9% price move in the last quarter complements the broader market's upward trajectory. Executive changes, such as the appointment of Stephen P. Hearn as COO, may have buttressed investor confidence, while consistent dividends likely contributed to maintaining shareholder interest amid this positive period.

Brown & Brown has 1 weakness we think you should know about.

The recent affirmation of Brown & Brown's (NYSE:BRO) quarterly dividend and the robust earnings growth reported for Q1 2025 could play a crucial role in maintaining investor confidence and possibly driving future revenue and earnings growth. This announcement aligns with the company's strategic efforts to solidify its market position through acquisitions and diversification, potentially bolstering its international presence and operational efficiencies. Furthermore, the appointment of Stephen P. Hearn as COO could help sustain investor optimism, potentially leading to stronger shareholder returns in the future.

Over the past five years, Brown & Brown's total shareholder return, including share price appreciation and dividends, reached 234.42%. This significant growth underscores the company's resilience and effectiveness in executing its business strategy. In comparison, over the last year, Brown & Brown's performance outpaced both the US Insurance industry and the broader US market, which returned 16.7% and 7.5%, respectively. This indicates a stronger short-term performance relative to the industry and market, highlighting the company's recent momentum.

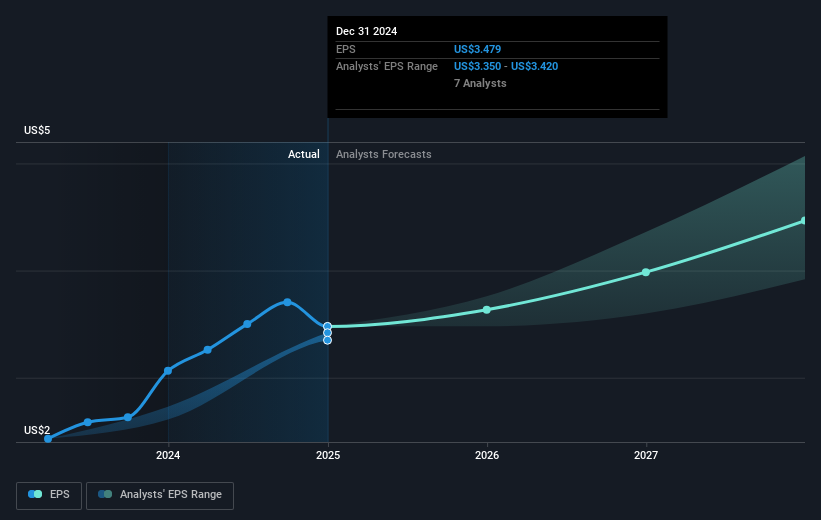

The projected revenue and earnings growth, driven by acquisitions and diversification, could be positively influenced by the current financial announcements. Analysts have set a consensus price target of US$119.81, slightly above the current share price of US$117.56, suggesting a mild undervaluation if the projected growth materializes. To fulfill these expectations, the company needs to achieve significant revenue growth and maintain or improve its net margins. The outlined strategic initiatives and leadership changes may provide the necessary impetus to meet these forecasts, though analysts recognize potential risks such as regulatory changes and competition in the M&A market.

Understand Brown & Brown's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal