Northern Trust (NasdaqGS:NTRS) Partners With ECO For Digital Carbon Credit Services

Northern Trust (NasdaqGS:NTRS) recently secured a service agreement with the UK's Ecosystem Certification Organisation, aiming to enhance transparency in the digital carbon credit market. Concurrently, the company posted solid quarterly earnings, with net income nearly doubling year-over-year and declared robust dividends. These developments coincide with favorable market trends, as stocks, including Northern Trust, rose on positive earnings and hopes for eased tariffs. The company's share price increased by 6.6% over the past week, aligning with an upward market trajectory, suggesting that the positive earnings report and strategic initiatives likely contributed to this momentum.

Northern Trust has 2 risks (and 1 which is a bit unpleasant) we think you should know about.

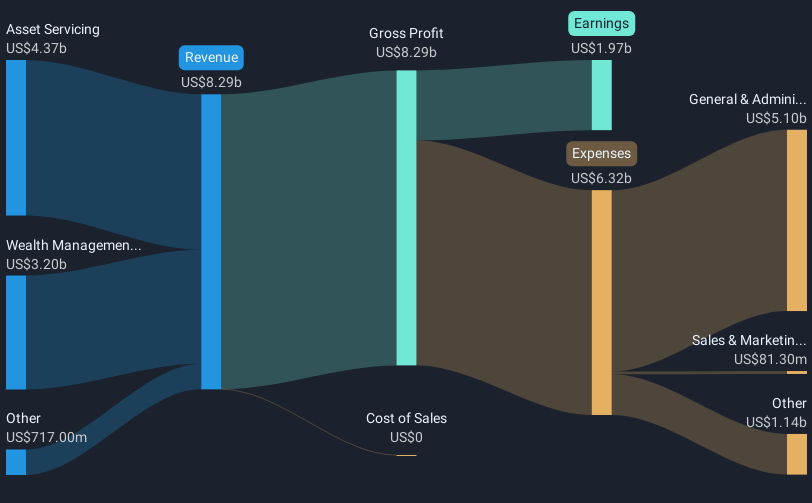

The recent service agreement with the UK's Ecosystem Certification Organisation could serve as a catalyst for Northern Trust to tap into the growing digital carbon credit market, aligning well with its strategic focus on alternative investments and family office services. Over the past five years, Northern Trust's total return, including share price and dividends, was 44.41%, which indicates a strong longer-term performance despite market volatility. However, in the past year, Northern Trust's earnings growth outpaced the industry average but underperformed relative to the US Capital Markets industry's return.

Looking ahead, the company's revenue and earnings forecasts face potential headwinds, including a forecasted annual revenue decrease of 1% and earnings decline of 12.1% per year over the next three years. These challenges may hinder Northern Trust's ability to achieve its consensus analyst price target of US$102.32. Despite this, the current share price of US$89.36 is discounted compared to the target, suggesting analysts believe its intrinsic value remains higher than the market perceives.

Review our historical performance report to gain insights into Northern Trust's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal