Entergy (NYSE:ETR) Reports Q1 Earnings With Net Income Rising To US$361 Million

Entergy (NYSE:ETR) recently announced strong first-quarter 2025 earnings, revealing significant improvements in sales, revenue, and net income. The company's basic EPS from continuing operations rose to $0.84 from $0.18 a year ago. Over the last quarter, Entergy's share price moved 10%, aligning closely with broader market trends. While the company's impressive financial results likely supported this positive trajectory, other events such as a $1.3 billion equity offering and dividend affirmations also played a part. Meanwhile, the overall market saw a 7.7% rise over the past year, buoyed by favorable earnings reports across various sectors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Entergy's recent first-quarter 2025 earnings report highlights robust improvements, with basic EPS climbing significantly. This positive momentum aligns with broader market trends, yet the longer-term picture reveals an even more compelling narrative. Over five years, Entergy's total shareholder return, inclusive of share price and dividends, reached a remarkable 115.98%. This notable performance contrasts with the past year's market return of 7.7%, demonstrating Entergy's strong value proposition across a wider temporal context.

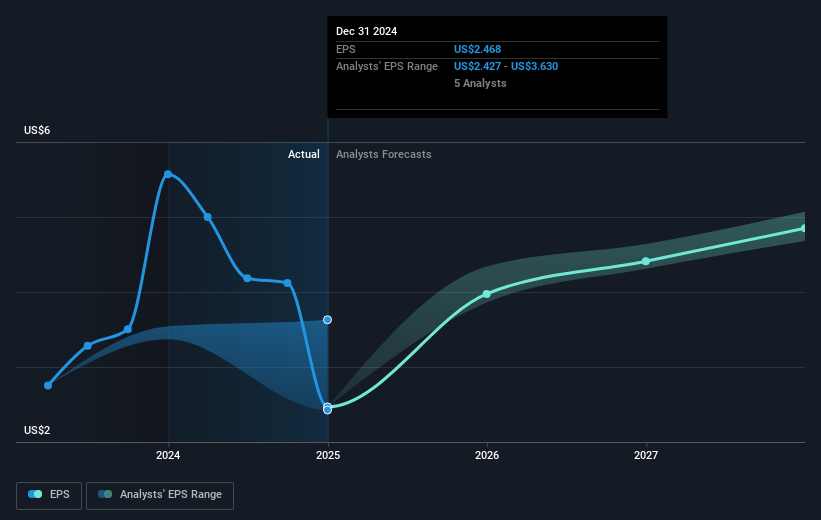

Amid this backdrop, the recent announcements of a $1.3 billion equity offering and an affirmed dividend can be perceived as bolstering Entergy's growth and sustaining investor confidence. Such moves could significantly influence revenue and earnings projections, especially as the company focuses on industrial sales and renewable energy projects. Analysts forecast revenue growth of 8% annually over the next three years, driven by these strategic initiatives. With the current share price of US$83.28 closely approaching the analyst consensus price target of US$89.01, the market appears to largely agree with these growth expectations, signaling a potential narrowing gap between current valuation and projected potential.

Evaluate Entergy's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal