Fiserv (NYSE:FI) Sees 14% Weekly Price Dip Despite Revenue and Net Income Rise

Fiserv (NYSE:FI) recently announced its Q1 earnings, showcasing a rise in revenue and net income, along with reaffirmed guidance for 2025. Despite these positive developments, the company's share price declined by 14% in the past week. This price movement diverged from the broader market trends, where major indices, such as the S&P 500 and Dow, extended their winning streaks. The recent lack of share repurchases might have added downward pressure on Fiserv's stock. Meanwhile, the launch of a fintech hub and executive shifts like the appointment of a new COO could contribute positively to its long-term strategies.

Be aware that Fiserv is showing 2 risks in our investment analysis.

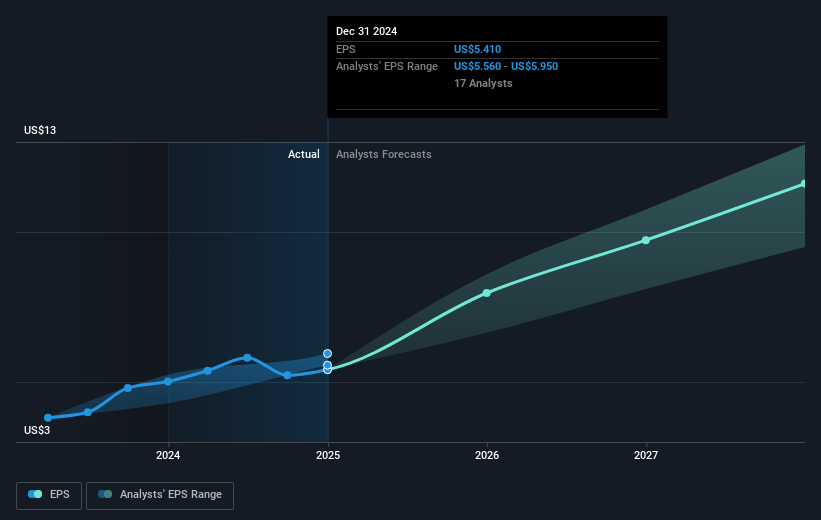

The recent share price decline of Fiserv, despite its Q1 earnings rise and reaffirmed 2025 guidance, could reflect market reactions to its temporary pause in share repurchases and adjustments in executive leadership. This shift aligns with its goal of long-term strategic growth through initiatives like the fintech hub. Over the past three years, Fiserv's total shareholder return, combining share price movements and dividends, increased by 83.29%. This longer-term performance provides a notable contrast to its recent short-term volatility.

In the past year, Fiserv underperformed the US Diversified Financial industry, which returned 20.8%, highlighting the recent challenges despite robust three-year gains. The current market reaction could influence revenue and earnings forecasts if the company's strategic initiatives, such as global expansion and partnerships with ADP and DoorDash, successfully capture anticipated opportunities. These efforts may potentially support the consensus analyst price target of $247.47, which sits 13.4% above the current share price of $214.29, despite recent price movements and market dynamics.

Explore historical data to track Fiserv's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal