Joseph G. Sauvage Joins American Electric Power Company (NasdaqGS:AEP) As Board Member

American Electric Power Company (NasdaqGS:AEP) recently experienced executive board changes with Joseph G. Sauvage being elected as a director. This, along with Donna James not seeking re-election, constitutes a substantial shift in its leadership. Despite this, AEP’s 7.06% share price rise last quarter was consistent with the broader market movements, which advanced by a similar margin over the past seven days. During this period, American Electric Power also saw positive financial developments, including growth in sales and net income, and a substantial equity offering. These factors likely supported the general positive market trend.

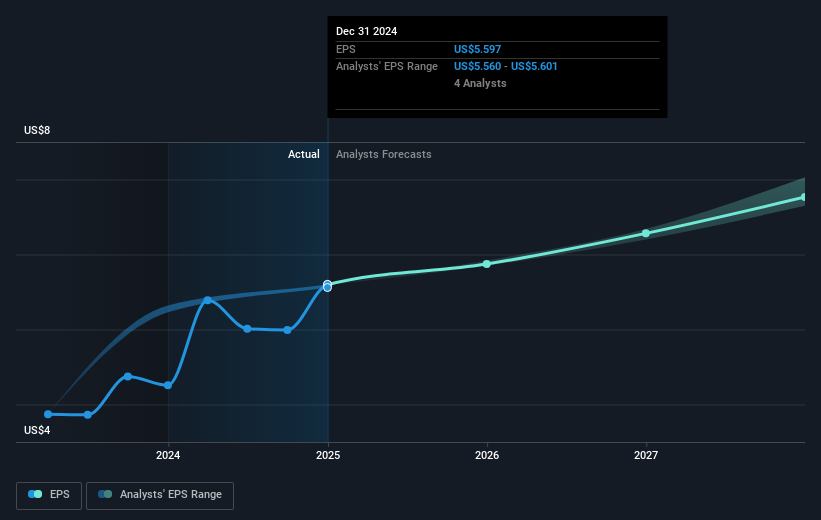

The recent executive board changes at American Electric Power Company, with Joseph G. Sauvage joining as a director and Donna James not seeking re-election, could influence the company’s strategic direction and decision-making. Such leadership shifts often bring fresh perspectives, impacting long-term strategic plans and potentially altering the company’s approach to capital projects and market challenges. Over the past five years, AEP has achieved a total return of 54.87%, including both share price appreciation and dividends. This demonstrates significant value creation for its shareholders compared to a 34.4% earnings surge in just the past year, overtaking the US Electric Utilities industry over a similar timeframe.

The company's strong track record is further evidenced by its recent outperformance against the broader market’s 7.5% increase over the past year. However, the recent share price, rising 7.06% last quarter, trades slightly above the consensus analyst price target of $106.64, showing minimal deviation. This suggests the market might view the current price as representative of its intrinsic value. The upcoming capital investments into energy infrastructure aim to drive future growth in revenue and earnings, yet they carry potential risks. The change in leadership could influence how the company manages execution and financing risks associated with its ambitious $54 billion investment plan. Investors will be closely watching how these governance changes affect long-term revenue and earnings forecasts. As the company looks to enhance its offerings, such developments could either positively or adversely affect earnings forecasts, with any missteps potentially leading to adjustments in its price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal