Ford Motor (NYSE:F) Declares US$0.15 Dividend for Second Quarter 2025

Ford Motor (NYSE:F) experienced a 5.81% price increase over the past week amid its recent news of a second-quarter dividend affirmation of 15 cents per share. This positive movement occurred as the broader market also climbed, with the Dow and S&P 500 continuing their winning streaks. Ford’s upward trend may align with overall positive market sentiment driven by strong earnings reports from other major companies and optimism around potential tariff adjustments. The market context, where key indices showed gains, likely supported Ford's price increase, making its performance consistent with general investor confidence in the week.

Ford Motor's recent affirmation of a second-quarter dividend of US$0.15 per share, coupled with a 5.81% share price increase this past week, complements its ongoing strategy focused on hybrid trucks and recurring services, potentially driving future success. Over the past five years, Ford's total shareholder return, including dividends, was 161.25%, reflecting favorable long-term performance. However, over the past year, Ford underperformed the US Auto industry, which returned 36.4% during the same period. The news of this week's price increase aligns with a broader market positivity influenced by robust earnings from various major players, hinting at a potential favorable outlook.

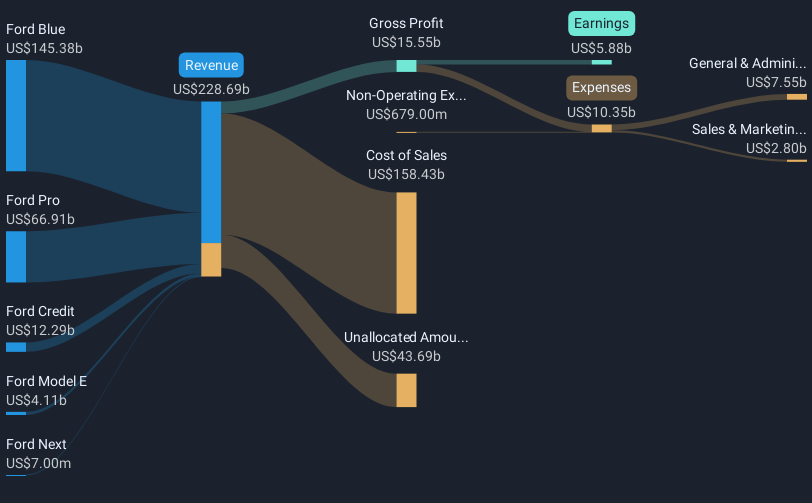

This recent dividend affirmation and price movement may affect Ford's revenue and earnings forecasts. The company's share is currently trading at US$8.69, below the analyst consensus price target of US$10.45, suggesting room for appreciation in the view of analysts. However, the assumption that revenue will face a 2.3% annual decline over three years and stable earnings around US$5.9 billion with only modest margin improvements could dampen enthusiasm. The timely dividend reaffirmation might signal resilience in Ford's foundational strategies, but the looming challenges in tariffs, EV competition, and macroeconomic factors continue to pose risks to its forecasted financial stability and market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal