Quanta Services (NYSE:PWR) Sees 15% Stock Price Increase Over Last Week

Quanta Services (NYSE:PWR) saw a notable stock price increase of 15% over the past week. This move aligns with broader market trends, as the Dow Jones and S&P 500 extended their winning streaks amid robust earnings reports and optimism regarding potential tariff adjustments. While Quanta Services did not experience any specific event affecting its shares, the overall positive market sentiment, spurred by strong corporate earnings and speculation around softened tariff policies, may have fueled the stock's recent rise. As the market continues to digest these economic signals, Quanta Services appears to be benefiting from the favorable investment environment.

You should learn about the 1 warning sign we've spotted with Quanta Services.

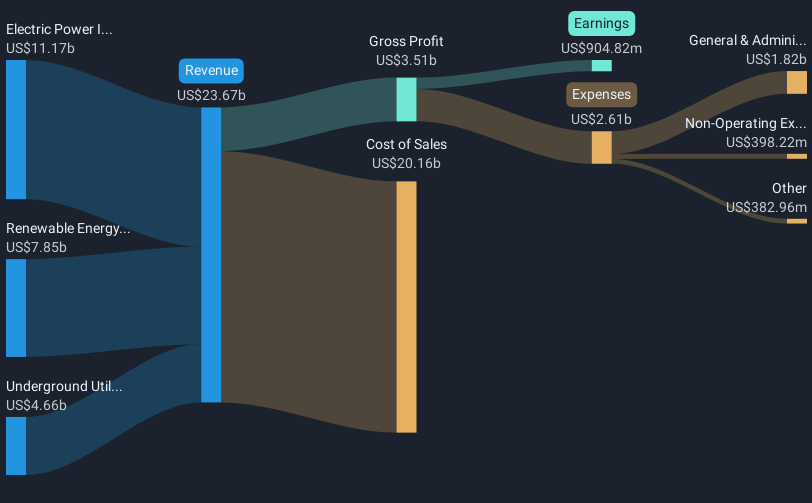

The recent uplift in Quanta Services' stock price aligns with broader market trends but does not stem from any company-specific events. This positive movement could enhance investor confidence, potentially leading to a reassessment of revenue and earnings forecasts. With strategic acquisitions such as the expansion in Australia and the Cupertino acquisition, Quanta is broadening its service lines and customer base, which analysts believe could bolster future revenue growth.

Over the last five years, Quanta Services' total shareholder return, including dividends, stood at a very large 746.22%. Comparatively, over the past year, the company's performance exceeded the US Market, which returned 7.7%, and matched the US Construction industry's 11.5% return. This indicates robust long-term performance relative to these benchmarks.

In the context of valuation, the share price movement, reaching US$261.85, is still below the consensus analyst price target of US$322.6, suggesting potential upside according to some analysts. Continuing external factors such as evolving trade policies could also influence revenue growth projections, possibly affecting the currently forecasted 14.3% annual earnings growth. With analysts predicting revenue to grow by 12.3% annually, adjustments to these expectations could further alter the perceived value of Quanta Services' shares.

Click to explore a detailed breakdown of our findings in Quanta Services' financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal