American Tower (NYSE:AMT) Announces 2025 Guidance With Revenue Range Of US$9,970M-US$10,120M

American Tower (NYSE:AMT) experienced a 13% price increase last quarter, reflecting the broader positive market trends where major indices saw gains. The company's recent earnings report showed a slight rise in revenue to $2,563 million, though net income decreased significantly to $489 million, which may have tempered investor expectations. The announcement of a dividend increase to $1.70 per share and the issuance of $1 billion in senior notes possibly supported the stock's upward movement. The broader market's anticipation of reduced tariffs likely also buoyed sentiment, contributing to the overall positive performance in line with market trends.

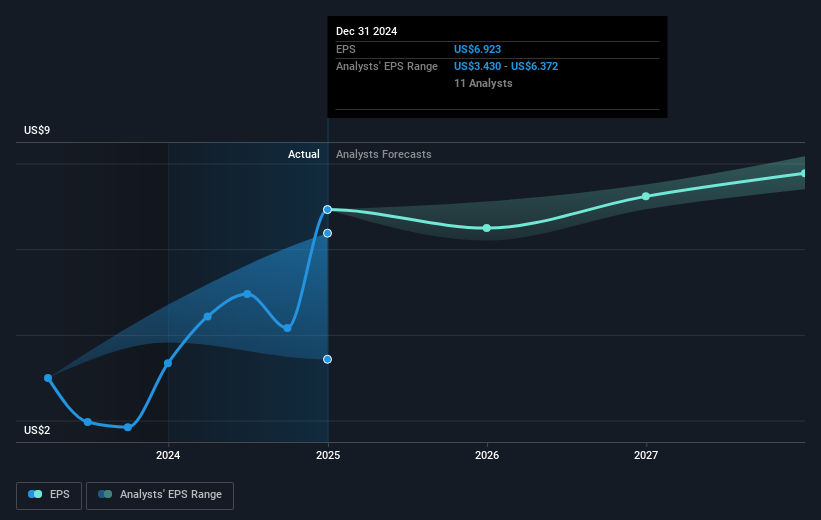

The recent developments at American Tower, including the dividend increase and debt issuance, have bolstered investor confidence in the company's financial stability and future capacity for growth. The positive share price movement aligns with these announcements, as well as broader market expectations related to tariff reductions. This has influenced revenue and earnings forecasts, hinting at potential improvements in financial performance with an expected strengthening of 5G and AI infrastructure demand. Analysts are projecting a slight revenue growth of 3.8% annually, with some margin compression, suggesting a cautious optimism about the company's growth trajectory despite macroeconomic uncertainties like carrier consolidation that could challenge these forecasts.

Analyzing longer-term performance, American Tower's total shareholder return was 24.75% over the past year, reflecting a robust recovery and outperforming the one-year US Specialized REITs industry return of 10.5%. This underscores investor confidence in the company's growth strategy and ability to adapt to industry trends. The share price, which shows a discount to the analyst consensus price target of US$235.75, suggests room for potential upside if the company meets or exceeds earnings expectations. Therefore, monitoring the company's progress in divesting high-risk assets and capitalizing on 5G and AI-driven demand remains crucial for sustaining shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal