Cadence Design Systems (NasdaqGS:CDNS) Raises 2025 Earnings Guidance to US$5.15-5.23 Billion

Cadence Design Systems (NasdaqGS:CDNS) notably demonstrated strong performance with a share price rise of 14% over the last week. This increase is particularly noteworthy given the company's recent earnings announcement showing Q1 revenue and net income growth, coupled with a raise in earnings guidance for the fiscal year. These positive developments occurred against the backdrop of a broader market upturn, where indices, including the Dow Jones and S&P 500, continued their winning streaks. Cadence's enhanced collaboration with TSMC to advance semiconductor technologies also contributed momentum, aligning with market optimism on tech innovation despite tariff uncertainties.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments in Cadence Design Systems, including robust collaborations with TSMC and a favorable earnings announcement, could bolster the company's strategic positioning in high-growth tech sectors. These initiatives may enhance revenue streams, especially in AI solutions, by strengthening partnerships with industry leaders like NVIDIA, Qualcomm, and Marvell. While the short-term share price rose 14% in the past week, the positive sentiment from enhanced guidance and collaboration could further support revenue and earnings forecasts for the upcoming periods.

Over the last five years, Cadence has achieved a substantial total return of 268.03%, indicating strong long-term performance. However, during the past year, the company's performance lagged behind the broader US market and the US Software industry, both of which outperformed Cadence's returns. This context highlights the importance of ongoing strategic initiatives to maintain competitive edge and continued growth momentum.

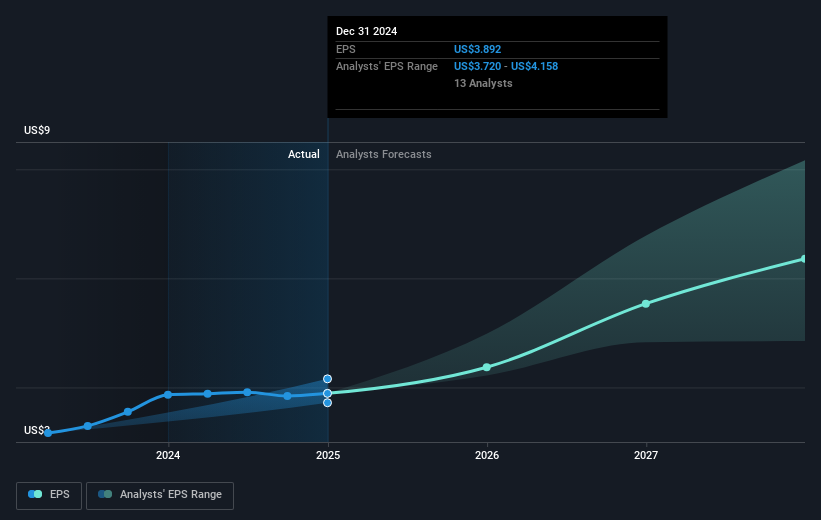

The recent 14% share price increase positions Cadence at a minor 9.26% discount to the consensus analyst price target of US$312.08. This suggests potential room for additional valuation gains if the company continues to meet or exceed market expectations. The strategic focus on expanding AI and hardware solutions could drive revenue growth, with analysts forecasting revenue to reach approximately $6.50 billion by 2028. If these forecasts are met, it could justify further upward revisions in share price targets. It's essential for investors to monitor how these factors evolve in relation to broader market trends and company-specific developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal