KKR (NYSE:KKR) Launches New Credit-Focused Interval Funds With Capital Group

KKR (NYSE:KKR) announced the launch of two new interval funds developed in collaboration with Capital Group, signaling a significant expansion into credit strategies. During the same week, the company's shares rose 16%, a notable increase amid a generally favorable market environment where major indices like the Dow Jones and S&P 500 experienced gains as well. KKR's proactive approach in broadening access to private market investments through these funds may have complemented the positive market sentiment driven by optimism around earnings reports and potential tariff relief. The broader market climbed 7% over the same period, reflecting strong investor confidence.

KKR has 1 possible red flag we think you should know about.

The recent launch of KKR's interval funds in collaboration with Capital Group could play a significant role in sustaining the company's long-term growth trajectory. By expanding its reach into credit strategies, KKR's initiative aligns well with its existing push into individual offerings like the K-Series and hybrid credit products. This expansion may enhance fee-related revenues by attracting a broader client base, supporting potential revenue and earnings growth amid otherwise volatile market conditions. The company's historical total return, including dividends, was a very large figure at 394.70% over five years, showcasing a robust performance against its 1-year return, which was higher than the US Capital Markets industry average of 18%.

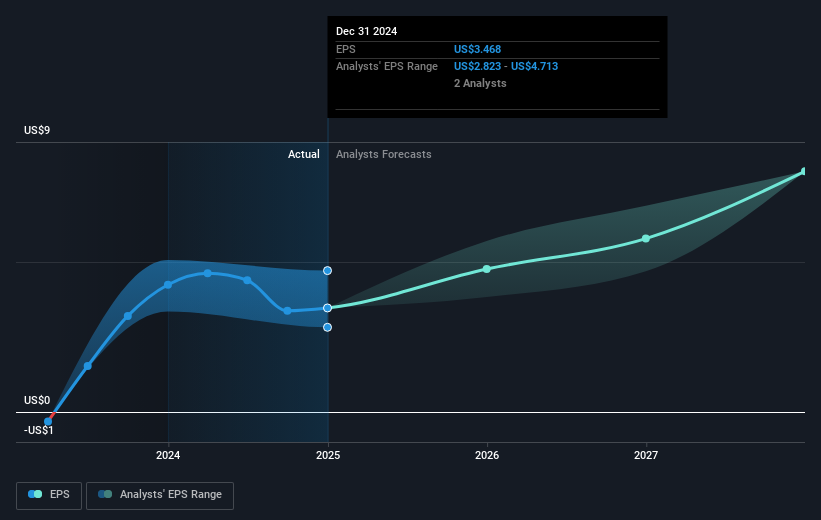

Given the changes in KKR's share price, up 16% recently, it's crucial to measure these movements against forecasts and targets. The analyst consensus price target stands at US$135.52, indicating a potential upside from the current price of US$102.28. However, this expected price increase emphasizes the significance of potential risks, such as integration and performance challenges linked to Global Atlantic, which could influence revenue forecasts. Analysts expect revenue to decline by 21.7% annually over the next few years, while profit margins are believed to improve. Such dynamics may affect valuation as the share trades at a premium compared to industry averages, reinforcing the need for investors to consider both growth prospects and inherent risks associated with KKR's evolving business model.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal