Ally Financial And 2 Other Stocks That May Be Undervalued For Savvy Investors

As the U.S. stock market experiences a rise, driven by strong earnings reports and anticipation of tariff news, investors are keenly observing potential opportunities amidst this evolving landscape. In such an environment, identifying undervalued stocks can be crucial for those looking to capitalize on market movements and secure long-term value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MINISO Group Holding (NYSE:MNSO) | $17.62 | $34.66 | 49.2% |

| ConnectOne Bancorp (NasdaqGS:CNOB) | $22.82 | $45.42 | 49.8% |

| Lantheus Holdings (NasdaqGM:LNTH) | $102.70 | $203.75 | 49.6% |

| Trade Desk (NasdaqGM:TTD) | $54.40 | $106.42 | 48.9% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.35 | $18.65 | 49.9% |

| Shift4 Payments (NYSE:FOUR) | $79.66 | $158.86 | 49.9% |

| Veracyte (NasdaqGM:VCYT) | $31.67 | $62.84 | 49.6% |

| BigCommerce Holdings (NasdaqGM:BIGC) | $5.27 | $10.36 | 49.1% |

| Verra Mobility (NasdaqCM:VRRM) | $21.99 | $43.04 | 48.9% |

| Roku (NasdaqGS:ROKU) | $68.14 | $135.48 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ally Financial (NYSE:ALLY)

Overview: Ally Financial Inc. is a digital financial-services company offering a range of digital financial products and services in the United States, Canada, and Bermuda, with a market cap of approximately $10.11 billion.

Operations: The company's revenue segments include $1.61 billion from Insurance operations, $546 million from Corporate Finance Operations, and $4.62 billion from Automotive Finance Operations.

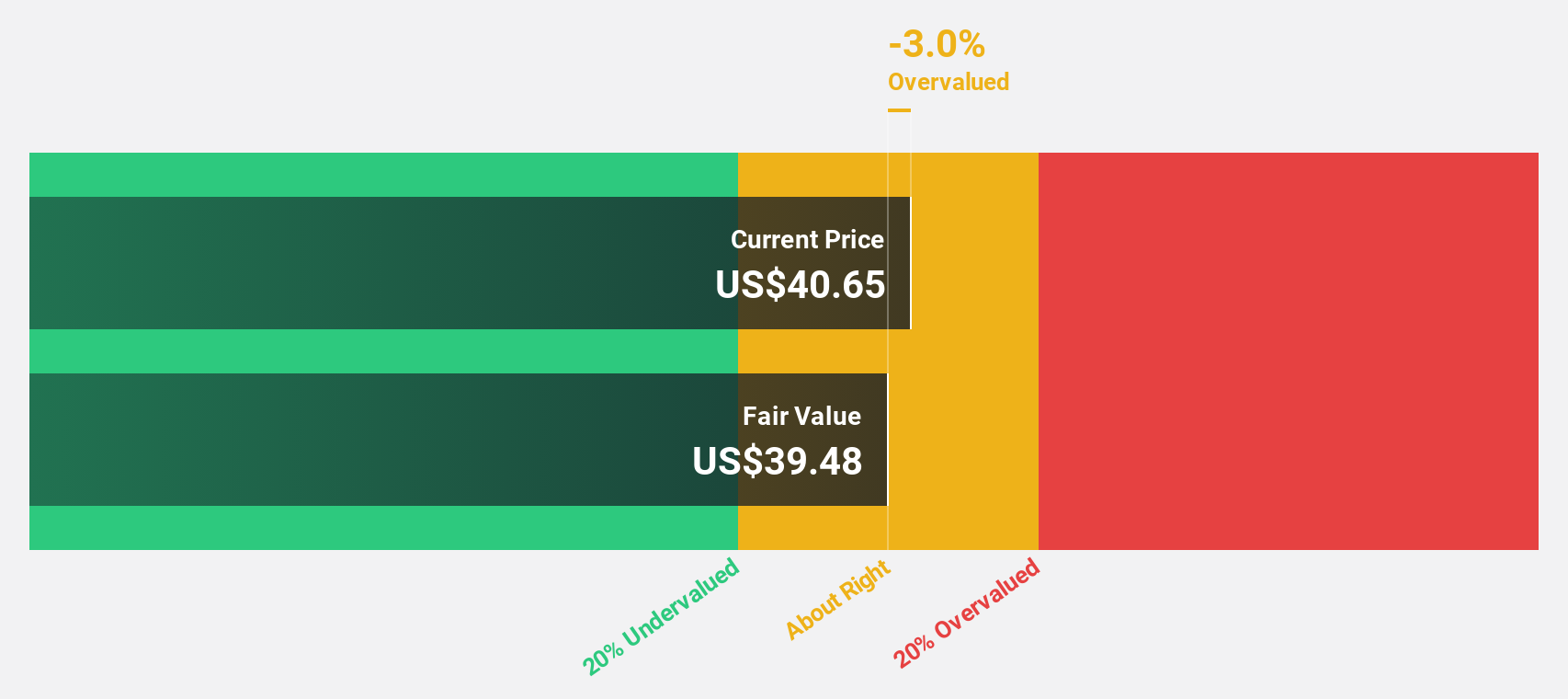

Estimated Discount To Fair Value: 15.1%

Ally Financial is trading at US$33.21, below its estimated fair value of US$39.13, suggesting it may be undervalued based on cash flows. Despite a recent net loss of US$225 million for Q1 2025, earnings are projected to grow significantly by 70.2% annually over the next three years, outpacing the broader market's growth rate. However, profit margins have decreased from last year and the dividend sustainability remains questionable given current earnings coverage challenges.

- Insights from our recent growth report point to a promising forecast for Ally Financial's business outlook.

- Click to explore a detailed breakdown of our findings in Ally Financial's balance sheet health report.

Elastic (NYSE:ESTC)

Overview: Elastic N.V. is a search artificial intelligence company that provides hosted and managed solutions for hybrid, public, private, and multi-cloud environments globally, with a market cap of approximately $8.79 billion.

Operations: The company's revenue is primarily generated from its Software & Programming segment, totaling approximately $1.43 billion.

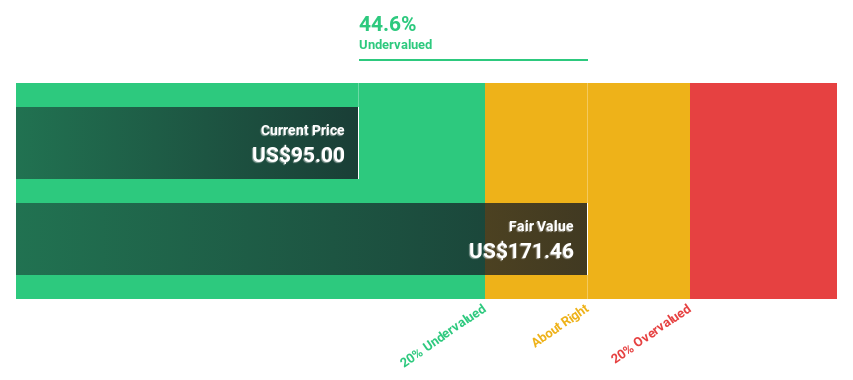

Estimated Discount To Fair Value: 47%

Elastic, trading at US$84.8, is significantly undervalued compared to its fair value estimate of US$159.91. The company is expected to become profitable within three years with earnings projected to grow by 47.66% annually, surpassing market averages. Recent product innovations like Automatic Migration enhance its competitive edge in security analytics but legal challenges and recent net losses highlight potential risks despite strong revenue growth forecasts and strategic leadership changes with a new CFO appointment.

- Our earnings growth report unveils the potential for significant increases in Elastic's future results.

- Take a closer look at Elastic's balance sheet health here in our report.

Evercore (NYSE:EVR)

Overview: Evercore Inc. is an independent investment banking firm operating across the Americas, Europe, Middle East, Africa, and Asia-Pacific with a market capitalization of $8.19 billion.

Operations: The company's revenue is primarily derived from Investment Banking & Equities, which generated $2.90 billion, and Investment Management, contributing $81.10 million.

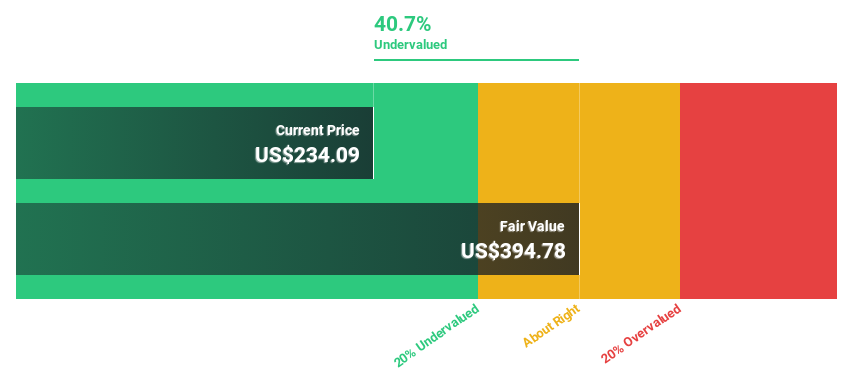

Estimated Discount To Fair Value: 25.7%

Evercore is trading at US$197.22, significantly below its estimated fair value of US$265.35, indicating it is undervalued based on discounted cash flow analysis. The firm's earnings grew by 48.1% last year and are forecast to increase by 19.87% annually, outpacing the broader U.S. market growth rate of 14.1%. Recent strategic hires in healthcare and M&A advisory bolster its capabilities, supporting revenue growth projections of 13% per year.

- According our earnings growth report, there's an indication that Evercore might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Evercore.

Make It Happen

- Unlock our comprehensive list of 183 Undervalued US Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal