A Look Into Freeport-McMoRan Inc's Price Over Earnings

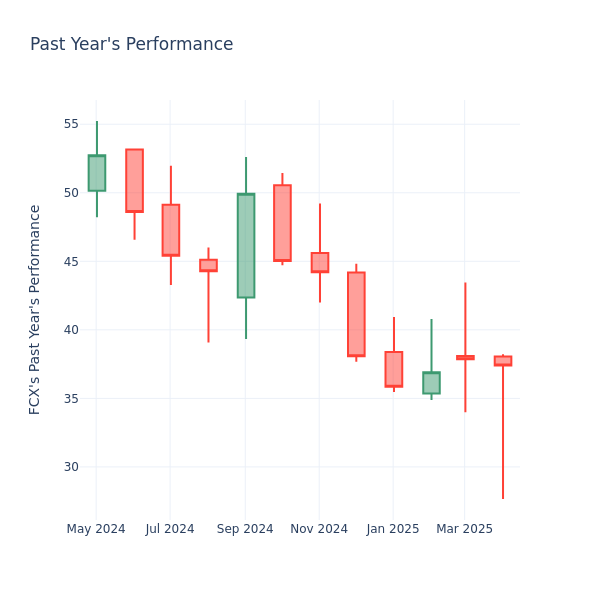

In the current market session, Freeport-McMoRan Inc. (NYSE:FCX) price is at $37.40, after a 0.42% spike. However, over the past month, the stock decreased by 1.94%, and in the past year, by 25.09%. Shareholders might be interested in knowing whether the stock is undervalued, even if the company is performing up to par in the current session.

A Look at Freeport-McMoRan P/E Relative to Its Competitors

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Freeport-McMoRan has a better P/E ratio of 30.52 than the aggregate P/E ratio of 24.76 of the Metals & Mining industry. Ideally, one might believe that Freeport-McMoRan Inc. might perform better in the future than it's industry group, but it's probable that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Wall Street Journal

Wall Street Journal