A Preview Of Brookfield Infr Partners's Earnings

Brookfield Infr Partners (NYSE:BIP) is preparing to release its quarterly earnings on Wednesday, 2025-04-30. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Brookfield Infr Partners to report an earnings per share (EPS) of $-0.05.

Investors in Brookfield Infr Partners are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

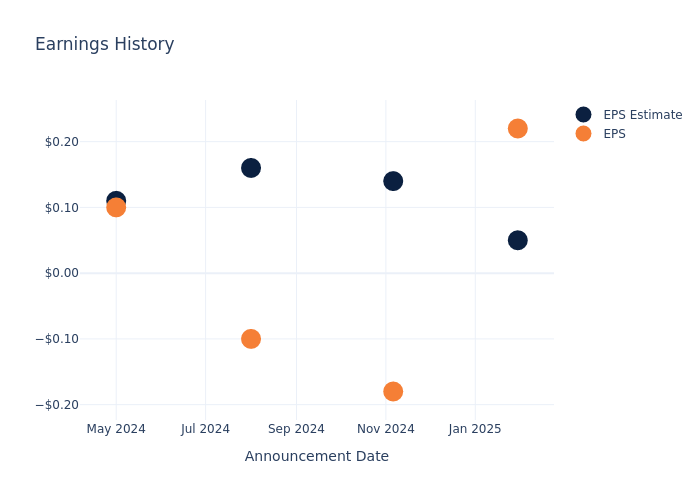

Earnings Track Record

The company's EPS beat by $0.17 in the last quarter, leading to a 2.26% drop in the share price on the following day.

Here's a look at Brookfield Infr Partners's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.05 | 0.14 | 0.16 | 0.11 |

| EPS Actual | 0.22 | -0.18 | -0.10 | 0.10 |

| Price Change % | -2.0% | -1.0% | -2.0% | 3.0% |

Brookfield Infr Partners Share Price Analysis

Shares of Brookfield Infr Partners were trading at $29.17 as of April 28. Over the last 52-week period, shares are up 5.27%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Brookfield Infr Partners

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Brookfield Infr Partners.

Brookfield Infr Partners has received a total of 4 ratings from analysts, with the consensus rating as Outperform. With an average one-year price target of $43.5, the consensus suggests a potential 49.13% upside.

Comparing Ratings with Peers

This comparison focuses on the analyst ratings and average 1-year price targets of CMS Energy, Black Hills and NorthWestern Energy Group, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for CMS Energy, with an average 1-year price target of $78.36, suggesting a potential 168.63% upside.

- Analysts currently favor an Neutral trajectory for Black Hills, with an average 1-year price target of $66.0, suggesting a potential 126.26% upside.

- Analysts currently favor an Outperform trajectory for NorthWestern Energy Group, with an average 1-year price target of $59.0, suggesting a potential 102.26% upside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for CMS Energy, Black Hills and NorthWestern Energy Group are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| NiSource | Outperform | 11.66% | $789.50M | 2.61% |

| CMS Energy | Outperform | 12.45% | $1.04B | 3.75% |

| Black Hills | Neutral | 0.91% | $248.80M | 2.82% |

| NorthWestern Energy Group | Outperform | 4.90% | $218.32M | 2.84% |

Key Takeaway:

Brookfield Infr Partners ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit and Return on Equity.

About Brookfield Infr Partners

Brookfield Infrastructure Partners LP is a Bermuda exempted limited partnership that owns and operates quality, long-life assets that generate stable cash flows, by virtue of barriers to entry or other characteristics that tend to appreciate in value over time. It focuses on acquiring infrastructure assets that have low maintenance capital costs and high barriers to entry. The company's segments consist of Utilities, Transport, Midstream, and Data. Geographically, it generates maximum revenue from USA and also has a presence in Australia, Colombia, United Kingdom, Brazil, United States of America, Chile, Peru, and other countries.

Brookfield Infr Partners: A Financial Overview

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Brookfield Infr Partners's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 9.54%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Utilities sector.

Net Margin: Brookfield Infr Partners's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 2.06%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Brookfield Infr Partners's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.99%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.11%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Brookfield Infr Partners's debt-to-equity ratio stands notably higher than the industry average, reaching 9.98. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal