Jones Lang LaSalle (NYSE:JLL) jumps 11% this week, though earnings growth is still tracking behind five-year shareholder returns

Jones Lang LaSalle Incorporated (NYSE:JLL) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 125% higher today. To some, the recent pullback wouldn't be surprising after such a fast rise. Only time will tell if there is still too much optimism currently reflected in the share price.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Jones Lang LaSalle achieved compound earnings per share (EPS) growth of 0.9% per year. This EPS growth is lower than the 18% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

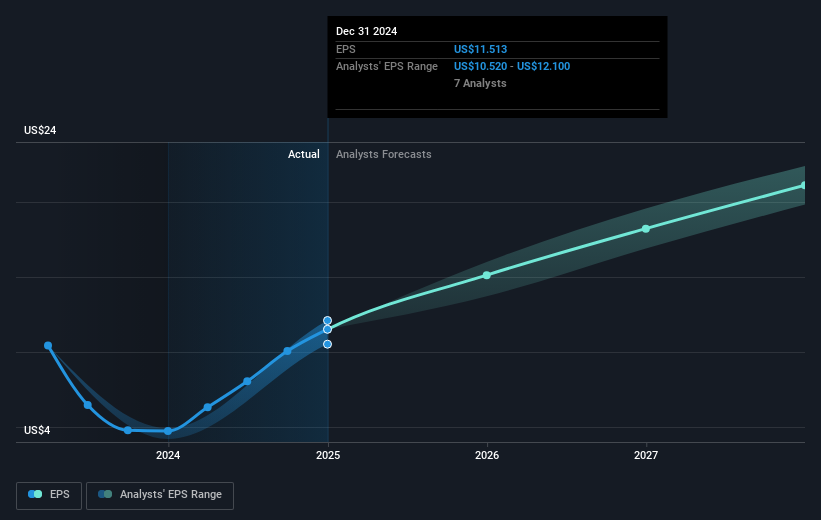

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Jones Lang LaSalle has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's good to see that Jones Lang LaSalle has rewarded shareholders with a total shareholder return of 24% in the last twelve months. That gain is better than the annual TSR over five years, which is 18%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is Jones Lang LaSalle cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal