GE HealthCare Technologies (NasdaqGS:GEHC) Shows 13% Stock Rise Over Last Week

GE HealthCare Technologies (NasdaqGS:GEHC) experienced a 13% rise in its share price over the last week, an impressive performance considering the broader market's 7% increase. Recent news indicates that the company showcased advancements in breast imaging technologies, such as Pristina Via and SmartMammo, at a symposium, potentially boosting investor confidence. Additionally, a collaboration with Cincinnati Children’s Hospital to improve pediatric care highlights GE HealthCare's commitment to innovation. Amidst tech sector losses influenced by declines in companies like Nvidia and Tesla, GE HealthCare's announcements likely added positive momentum to its stock's notable performance.

We've spotted 1 possible red flag for GE HealthCare Technologies you should be aware of.

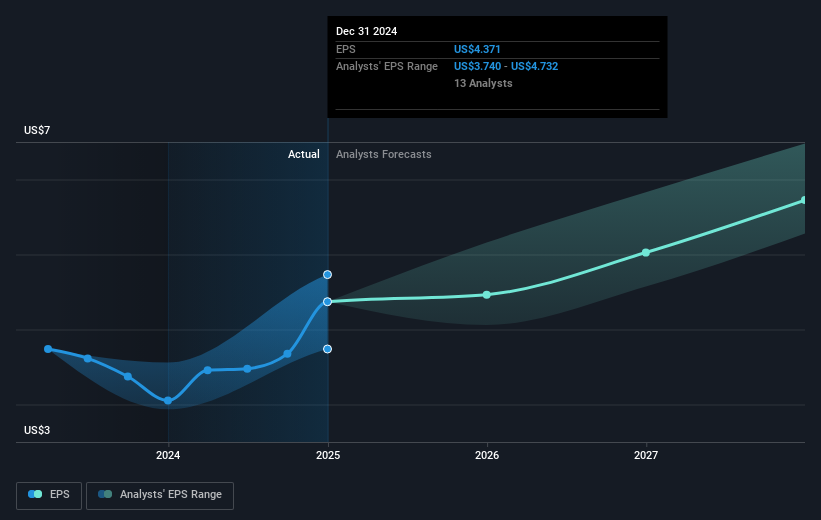

The recent advancements in breast imaging technologies and the collaboration with Cincinnati Children’s Hospital could bolster GE HealthCare Technologies' growth narrative by enhancing its market position and driving demand in high-margin product categories. These developments suggest potential for increased future revenue and earnings, aligning with analyst expectations of annual 3.7% revenue growth and a rise in profit margins. However, challenges such as exposure to China's market volatility and competitive pressures could impact these forecasts.

Over the longer-term period of the last year, GE HealthCare experienced a 22.95% total return decline, contrasting its short-term success. This underperformance is noteworthy, given that the company's earnings have grown by 43.5% over the past year, exceeding the Medical Equipment industry's 8.5% growth. Despite recent advancements, GE HealthCare underperformed the broader US market, which returned 7.5% over the past year.

The recent price surge positions GE HealthCare's share price close to analysts' consensus price target, which anticipates a 41.8% increase from the current price. With a discounted fair value estimate and earnings growth potential, as indicated by a Price-To-Earnings Ratio of 15.7x compared to the industry average of 31.6x, there remains optimism. Understanding these dynamics allows investors to assess if the current price movements align with the optimistic analyst projections of further appreciation. However, as always, it's wise to independently evaluate these metrics based on personal insights and expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal