CAVA Group (NYSE:CAVA) Climbs 13% In A Week

CAVA Group (NYSE:CAVA) recently launched its Hot Harissa Pita Chips and a seasonal Strawberry Citrus Juice, supplemented by a promotional music video. These initiatives might have helped support CAVA's 13% price gain last week, despite broader market indexes declining, with the Dow down 0.3% and the S&P 500 and Nasdaq Composite also lower. Additionally, CAVA’s recent inclusion in the S&P 1000 index could have further increased investor interest. In contrast, the broader market's decline was countered slightly by CAVA’s positive performance, possibly due to these engaging product launches and its strategic index addition.

We've spotted 1 weakness for CAVA Group you should be aware of.

The recent news of CAVA Group's product launches and inclusion in the S&P 1000 index might influence investor sentiment positively, driving short-term share price gains. Over the longer term, CAVA's shares experienced a total shareholder return of 28.63% over the last year, showcasing its substantial growth compared to its industry and market peers. Specifically, CAVA outperformed the US Hospitality industry which returned 2.8%, and the broader US market which returned 7.5% over the same period.

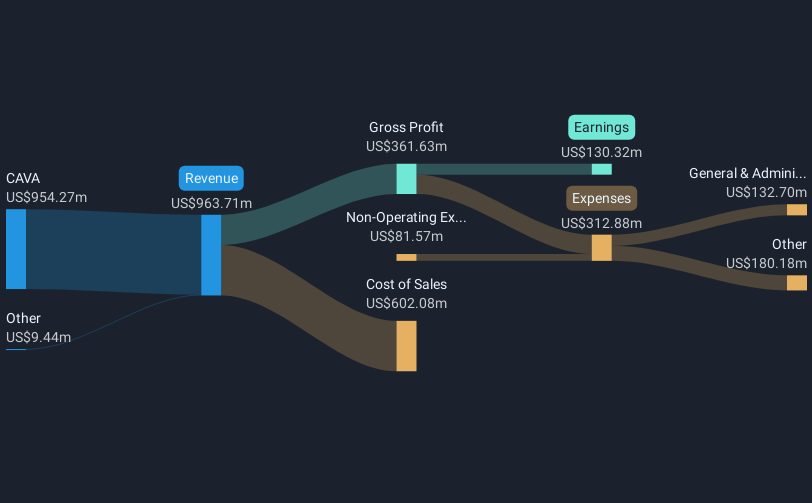

The impact of launching new products such as the Hot Harissa Pita Chips and a strategic market entry into the S&P 1000 could potentially boost CAVA's revenue by widening its consumer base and improving market visibility. However, this growth comes with margin pressure risks, more evident with the introduction of premium-priced menu items like grilled steak. Analysts forecast earnings will decrease from US$130.32 million to US$109.6 million by April 2028, emphasizing the challenges ahead in balancing costs against revenue growth.

Despite these risks, analysts have set a consensus price target of US$117.64, suggesting upside potential from the current share price of US$81.30. This reflects a significant discount to the price target, signaling that the market might currently undervalue the company's future prospects. Investors should consider the implications of CAVA's growth strategy on their long-term forecasts and evaluate the underlying assumptions that inform these analyst expectations.

Learn about CAVA Group's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal