Arista Networks (NYSE:ANET) Climbs 15% Over Last Week

Arista Networks (NYSE:ANET) experienced a notable shift in its stock price with a 15% rise last week, amidst a period of mixed market performance marked by declines in major indexes like the Dow Jones and Nasdaq. This suggests that the company's stock movements could have been buoyed by internal factors or sector-specific developments, rather than broader market trends. With the market broadly higher over the last week, any recent industry-specific news or internal events at Arista Networks could have potentially provided additional influence, although such specifics were not immediately available based on provided data for analysis.

Be aware that Arista Networks is showing 1 risk in our investment analysis.

The recent news about Arista Networks' substantial 15% surge in stock price amidst a mixed market environment highlights the potential influence of internal developments or sector-specific trends. This movement may energize the company narrative, which emphasizes AI networking and CloudVision as growth drivers. The growth initiatives outlined suggest possible future revenues of US$10 billion, leveraging proprietary software to enhance margins. Meanwhile, the longer-term total shareholder return of very large over the past five years underscores strong historical performance.

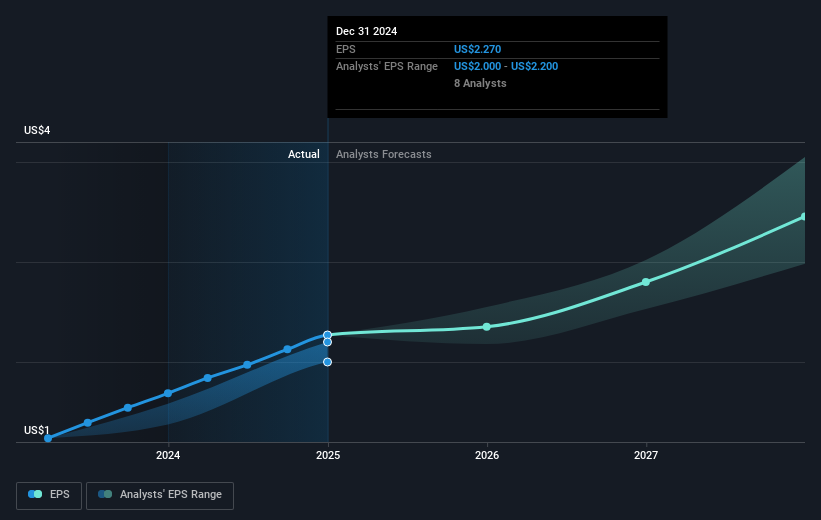

Considering Arista Networks' past year, it underperformed the US Communications industry which returned 22.5%. Yet, over the last year, it outstripped the US market, which posted a 7.5% increase, showing resilience in challenging market conditions. The current jump in share price could potentially influence revenue and earnings projections, aligning them closer to analyst expectations. With optimistic analyst projections valuing shares at US$104.46, Arista's current price movement can be viewed as a step towards reaching the consensus target, with room to grow based on the bullish target of US$145.00.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal