EMCOR Group (NYSE:EME) Stock Surges 13% Over The Last Week

EMCOR Group (NYSE:EME) recently announced a quarterly cash dividend of $0.25, underlining its commitment to shareholder value. Despite a challenging market week, where major indices like the S&P 500 and Dow saw declines, EMCOR Group saw its stock price rise by 13%. This significant movement contrasts with broader market trends, where technology stocks led declines. While broader market influences played a role, the reassurance provided by the dividend announcement and the company's reaffirmed dedication to shareholder returns likely added weight to the positive price movement observed in the company's stock last week.

Every company has risks, and we've spotted 1 warning sign for EMCOR Group you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

EMCOR Group's recent dividend announcement, amid broader market declines, underscores its focus on return to shareholders, simultaneously boosting investor sentiment. This comes on the heels of a very large five-year total shareholder return, which includes dividends and saw EMCOR Group's stock price rise significantly, reflecting long-term investor confidence. For context, over the past year, EMCOR's performance remained superior to both the US construction industry and the overall US market, highlighting its resilience and operational strength.

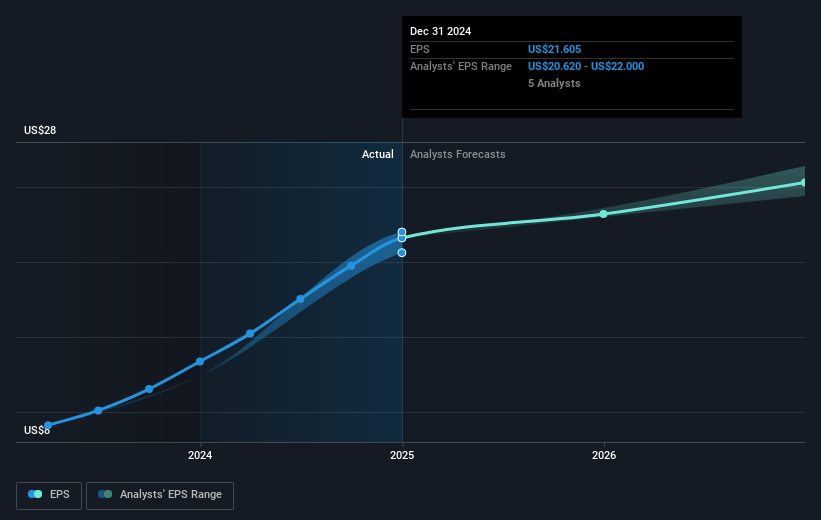

Considering the acquisition of Miller Electric, EMCOR's expansion into data centers and manufacturing could further enhance revenue and earnings predictions. The $700 million in repeat project opportunities (RPOs) tied to the acquisition is likely to support EMCOR's anticipated revenue growth. With analysts forecasting earnings to rise to US$1.2 billion by 2028, the market might adjust its expectations following these strategic movements. The positive price movement, increasing despite market headwinds, positions the company's current share price closer to the analyst consensus price target of US$486.60. Investors are encouraged to evaluate their own expectations of EMCOR's future performance in light of these developments.

Assess EMCOR Group's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal