Discovering US Market's 3 Undiscovered Gem Stocks

The United States market has shown a robust performance recently, rising 7.0% over the last week and 7.5% over the past year, with earnings projected to grow by 14% annually in the coming years. In this dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking to capitalize on emerging trends and potential value within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

HarborOne Bancorp (NasdaqGS:HONE)

Simply Wall St Value Rating: ★★★★★★

Overview: HarborOne Bancorp, Inc. offers financial services to individuals, families, small and mid-size businesses, and municipalities with a market capitalization of approximately $491.52 million.

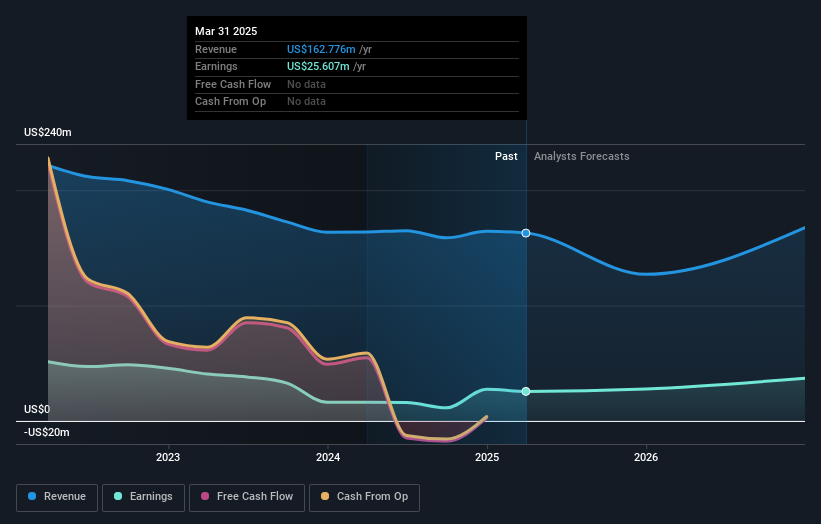

Operations: The company generates revenue primarily from its HarborOne Bank segment, contributing $143.61 million, and HarborOne Mortgage, which adds $19.01 million.

HarborOne Bancorp, with total assets of US$5.7 billion and equity of US$576 million, stands out for its robust financial health. It holds deposits totaling US$4.6 billion and loans amounting to US$4.8 billion, showcasing a solid loan-to-deposit ratio. The bank's allowance for bad loans is ample at 0.6% of total loans, indicating prudent risk management practices. Over the past year, earnings surged by 59%, significantly outperforming the banks industry average growth of 3%. Recently, HarborOne completed a share buyback program worth US$25 million and announced a merger agreement with Eastern Bankshares valued at approximately $510 million.

- Click here and access our complete health analysis report to understand the dynamics of HarborOne Bancorp.

Examine HarborOne Bancorp's past performance report to understand how it has performed in the past.

Donnelley Financial Solutions (NYSE:DFIN)

Simply Wall St Value Rating: ★★★★★★

Overview: Donnelley Financial Solutions, Inc. offers software and technology-enabled financial regulatory and compliance solutions across various regions worldwide, with a market cap of approximately $1.28 billion.

Operations: DFIN generates revenue through four primary segments: Capital Markets - Software Solutions ($213.60 million), Investment Companies - Software Solutions ($116.10 million), Capital Markets - Compliance and Communications Management ($321.70 million), and Investment Companies - Compliance and Communications Management ($130.50 million).

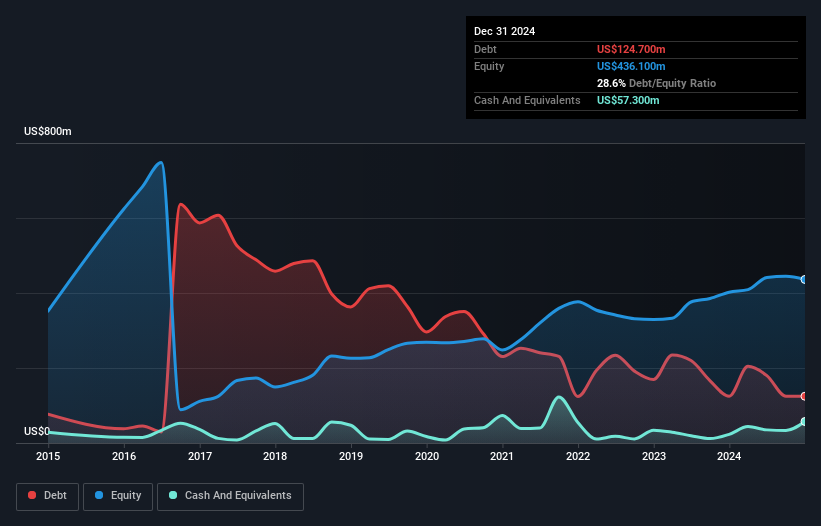

Donnelley Financial Solutions is carving a niche with its focus on software solutions and compliance products, which bolster both revenue and margins. Its net debt to equity ratio stands at 15.5%, reflecting a satisfactory financial position, while interest payments are well-covered by EBIT at 10.4 times. The company has reduced its debt to equity from 110.2% to 28.6% over five years, showcasing prudent financial management. Recent strategic investments in regulatory platforms aim to capture future demand from new regulations, despite challenges from weak transaction markets and declining print revenues that could impact overall earnings growth.

Teekay (NYSE:TK)

Simply Wall St Value Rating: ★★★★★★

Overview: Teekay Corporation Ltd. is engaged in providing crude oil marine transportation and other marine services on a global scale, with a market capitalization of approximately $591.46 million.

Operations: Teekay generates revenue primarily from its Tankers segment, contributing $1.11 billion, and Marine Services and Other segment, adding $114.10 million.

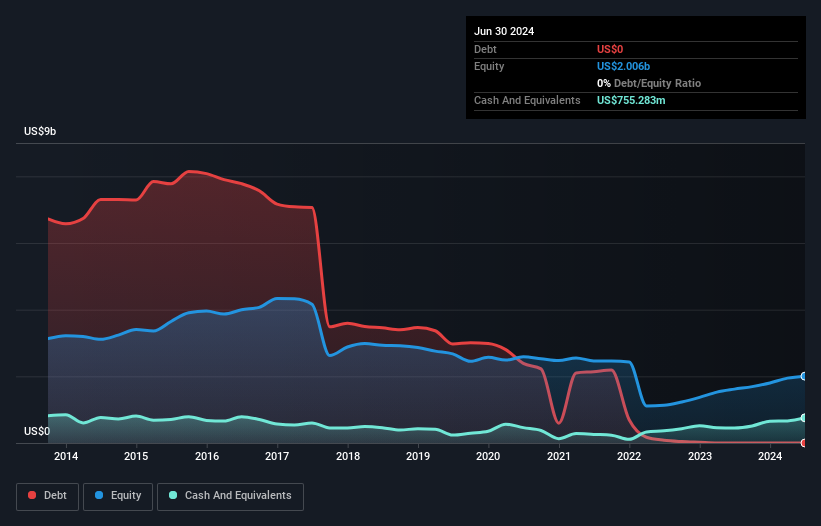

Teekay, a notable player in the oil and gas sector, has shown resilience despite challenging conditions. Over the past year, earnings growth was negative at 11.2%, yet it outperformed the industry average of 22.8%. The company stands out with zero debt compared to a hefty debt-to-equity ratio of 116.1% five years ago, reflecting significant financial improvement. Trading at a steep discount of 90.4% below its estimated fair value suggests potential for upside. Recent figures indicate net income for Q4 was US$25 million on sales of US$257 million, highlighting both opportunities and challenges ahead for investors considering this stock.

- Delve into the full analysis health report here for a deeper understanding of Teekay.

Gain insights into Teekay's historical performance by reviewing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 291 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal