AGCO (NYSE:AGCO) Has Announced A Dividend Of $0.29

The board of AGCO Corporation (NYSE:AGCO) has announced that it will pay a dividend of $0.29 per share on the 16th of June. Based on this payment, the dividend yield on the company's stock will be 4.4%, which is an attractive boost to shareholder returns.

Our free stock report includes 2 warning signs investors should be aware of before investing in AGCO. Read for free now.Estimates Indicate AGCO's Dividend Coverage Likely To Improve

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. AGCO is not generating a profit, and despite this is paying out most of its free cash flow as a dividend. Paying a dividend while unprofitable is generally considered an aggressive policy, and with limited funds retained for reinvestment, growth may be slow.

Analysts expect a massive rise in earnings per share in the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 15%, which makes us pretty comfortable with the sustainability of the dividend.

See our latest analysis for AGCO

Dividend Volatility

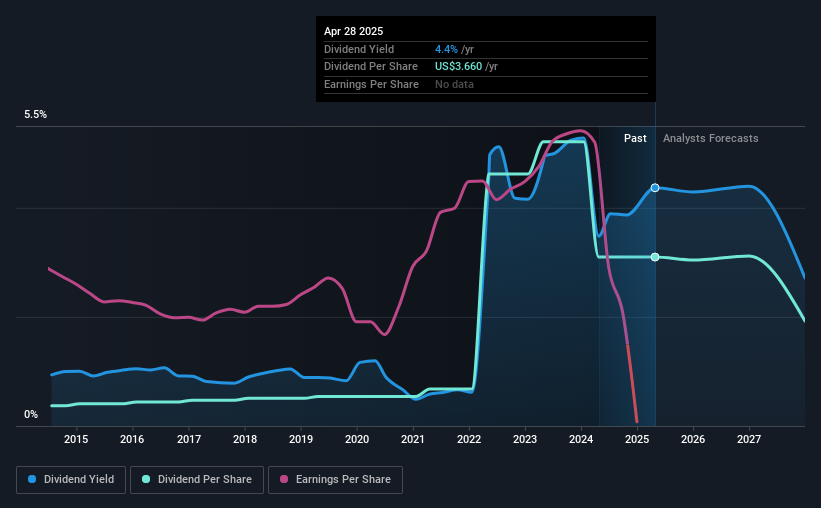

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was $0.44 in 2015, and the most recent fiscal year payment was $3.66. This works out to be a compound annual growth rate (CAGR) of approximately 24% a year over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Company Could Face Some Challenges Growing The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's encouraging to see that AGCO has been growing its earnings per share at 11% a year over the past five years. It's not great that the company is not turning a profit, but the decent growth in recent years is certainly a positive sign. All is not lost, but the future of the dividend definitely rests upon the company's ability to become profitable soon.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about AGCO's payments, as there could be some issues with sustaining them into the future. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, AGCO has 2 warning signs (and 1 which can't be ignored) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal