9 Analysts Assess Gaming and Leisure Props: What You Need To Know

Gaming and Leisure Props (NASDAQ:GLPI) underwent analysis by 9 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 4 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 0 | 2 | 2 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

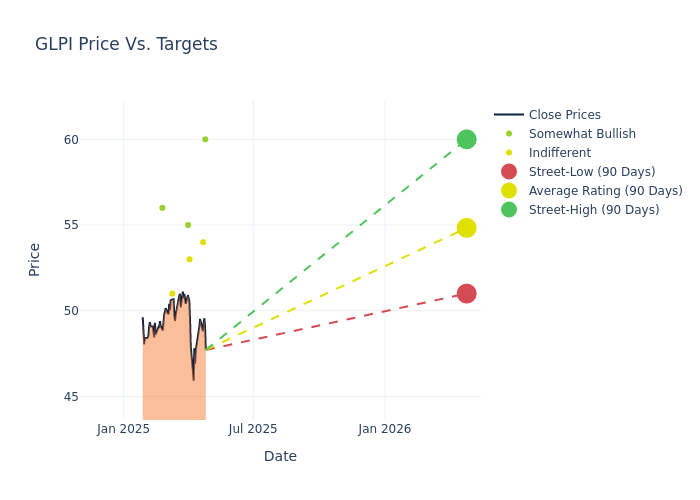

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $54.67, a high estimate of $60.00, and a low estimate of $51.00. This upward trend is evident, with the current average reflecting a 0.2% increase from the previous average price target of $54.56.

Exploring Analyst Ratings: An In-Depth Overview

A comprehensive examination of how financial experts perceive Gaming and Leisure Props is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|------------------------|---------------|-----------------|--------------------|--------------------| |Chad Beynon |Macquarie |Maintains |Outperform | $60.00|$60.00 | |Richard Hightower |Barclays |Raises |Equal-Weight | $54.00|$53.00 | |Haendel St. Juste |Mizuho |Raises |Neutral | $53.00|$51.00 | |Mitch Germain |Citizens Capital Markets|Maintains |Market Outperform| $55.00|$55.00 | |John Kilichowski |Wells Fargo |Raises |Equal-Weight | $51.00|$50.00 | |Richard Hightower |Barclays |Lowers |Equal-Weight | $53.00|$55.00 | |Mitch Germain |Citizens Capital Markets|Maintains |Market Outperform| $55.00|$55.00 | |Brad Heffern |RBC Capital |Lowers |Outperform | $56.00|$57.00 | |Mitch Germain |Citizens Capital Markets|Maintains |Market Outperform| $55.00|$55.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Gaming and Leisure Props. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Gaming and Leisure Props compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Gaming and Leisure Props's stock. This analysis reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Gaming and Leisure Props's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Gaming and Leisure Props analyst ratings.

Delving into Gaming and Leisure Props's Background

Gaming and Leisure Properties Inc, or GLP, is a real estate investment property trust whose primary business consists of acquiring, financing, and owning real estate property to be leased to gaming operators in triple-net lease arrangements. The GLPI's portfolio consisted of interests in sixty one gaming and related facilities, the real property associated with thirty four gaming and related facilities operated by PENN, the real property associated with six gaming and related facilities operated by Caesars Entertainment Corporation.

Gaming and Leisure Props: Delving into Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining Gaming and Leisure Props's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.58% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 55.71%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Gaming and Leisure Props's ROE stands out, surpassing industry averages. With an impressive ROE of 5.09%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.67%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.88.

How Are Analyst Ratings Determined?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal