Broadridge Financial Solutions (NYSE:BR) Partners With OneDigital To Enhance Retirement Business

Broadridge Financial Solutions (NYSE:BR) recently announced a partnership with OneDigital Financial Services to enhance their retirement business capabilities. This collaboration, which includes data aggregation and enhanced business reporting tools, came amid market fluctuations and broadly positive trends, with major indices posting gains despite tariff uncertainties. Broadridge's stock price movement last week remained essentially flat, aligning with the mixed market conditions, as the Dow Jones experienced a slight dip and broader indices saw mixed results. The recent client announcements added some weight to the broader market movements influencing the company's performance.

The recent partnership between Broadridge Financial Solutions and OneDigital Financial Services signifies a strategic move to bolster Broadridge's capabilities in the retirement business sector. This collaboration is expected to enhance their service offerings through improved data aggregation and business reporting tools. Such advancements are likely to support Broadridge's ongoing investments in technology and innovation, potentially leading to long-term margin expansion and an uptick in earnings. While the company's share price remained stable last week amid mixed market conditions, this strategic development could have positive implications for future revenue growth and market positioning.

Over a five-year period, Broadridge's total shareholder return, including dividends, was 123.31%, demonstrating the company's robust long-term performance. Comparatively, over the past year, Broadridge exceeded the US Market's return of 5.9% and the 6.5% return of the US Professional Services industry. This outperformance reflects consistent earnings growth and strategic market engagements.

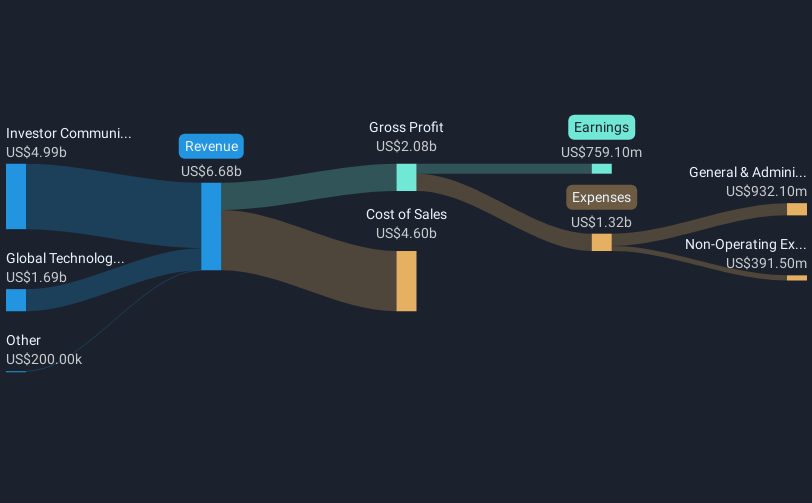

Broadridge's current share price of US$235 is closely aligned with the consensus analyst price target of US$243.93, showing a modest 3.7% potential increase. The company's longer-term earnings forecasts depict a promising scenario with expected revenue of $7.9 billion and earnings of $1.1 billion by 2028. This underscores the expected impact of their recent business initiatives and improvements in cost efficiencies and market reach. As such, the partnership with OneDigital could further strengthen revenue and earnings forecasts by leveraging technological and market expansion strategies in the evolving financial services landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal