Republic Services (NYSE:RSG) Reports Q1 Sales and Income Growth with US$4 Billion Revenue

Republic Services (NYSE:RSG) showcased strong financial performance in its first quarter of 2025, with sales rising to $4,009 million and net income increasing to $495 million. These results, alongside a quarterly dividend affirmation and expansion efforts such as the inauguration of a new Polymer Center, may have bolstered the company's share price by 14% over the last quarter. While the market showed a mix of trends due to tariff uncertainties, Republic Services' developments provided an additional boost against a backdrop of overall market gains, as evidenced by the S&P 500's 8% rise over the past year.

Republic Services has 2 risks we think you should know about.

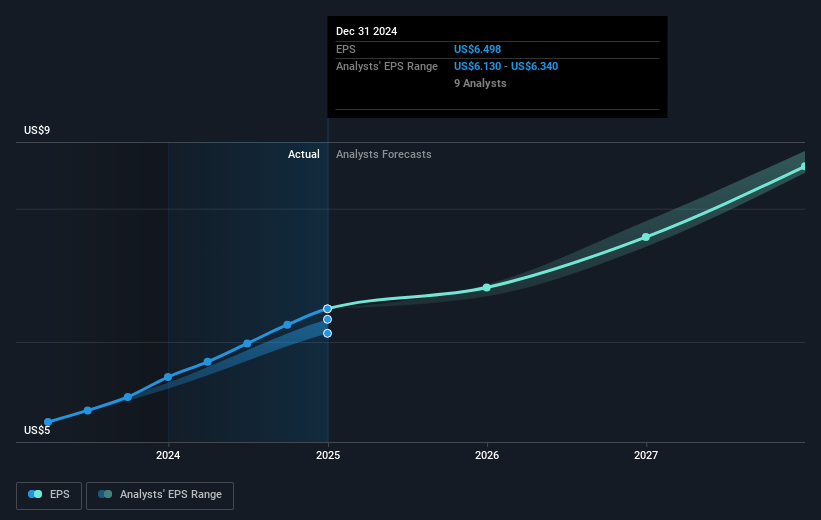

Republic Services' initiatives in digital expansion and renewable energy projects, as highlighted in the introduction, could significantly drive revenue and earnings growth. The launch of Polymer Centers and the M-Power system are anticipated to enhance operational efficiency and financial performance, aiming to bolster net margins and elevate productivity. These endeavors, if executed effectively, could mitigate potential economic challenges discussed in the narrative, such as commodity price fluctuations and tax credit changes.

Looking at the longer-term context, Republic Services has delivered a total shareholder return of 230.01% over a five-year period, showcasing robust growth. Compared to the US Commercial Services industry and broader market, Republic Services outperformed both industry benchmarks and market averages over the past year. Such performance underscores the potential impact of the company's strategic moves on shareholder value.

The recent share price increase places it close to the analyst consensus price target of US$245.76, suggesting that the market may already be factoring in the company’s growth prospects and strategic initiatives. Although the current share price of US$242.57 is slightly below the target, the marginal difference of 1.3% indicates that Republic Services is viewed as fairly priced at this point. As the market continues to assess these developments, it’s crucial for investors to stay informed of the company's execution on its projected plans.

Review our historical performance report to gain insights into Republic Services' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal