Snap-on (NYSE:SNA) Declares US$2.14 Quarterly Dividend for June 2025

Snap-on (NYSE:SNA) recently affirmed a quarterly common stock dividend of $2.14 per share, scheduled for June 10, 2025, a move that may have buttressed its stock performance amidst broader market shifts. Over the last week, the company's shares rose 2%, aligning closely with the overall market's positive sentiment. Results were mixed as stocks reacted to tariff uncertainties and varying earnings reports from significant corporates. The consistent dividend declaration might have provided additional buoyancy to Snap-on's stock, marking a slight upward trend during a period of overall market gains, despite broader economic concerns.

Buy, Hold or Sell Snap-on? View our complete analysis and fair value estimate and you decide.

The affirmation of Snap-on's dividend may bolster investor confidence, fostering a stable outlook amid economic uncertainties expressed in the narrative. This dividend stability potentially supports investor sentiment that the company remains resilient despite broader market challenges. Over the past five years, Snap-on's total return of 171.8% reflects significant growth, significantly outpacing the broader market's performance over the past year. This historical context suggests robust longer-term investment returns compared to more recent periods.

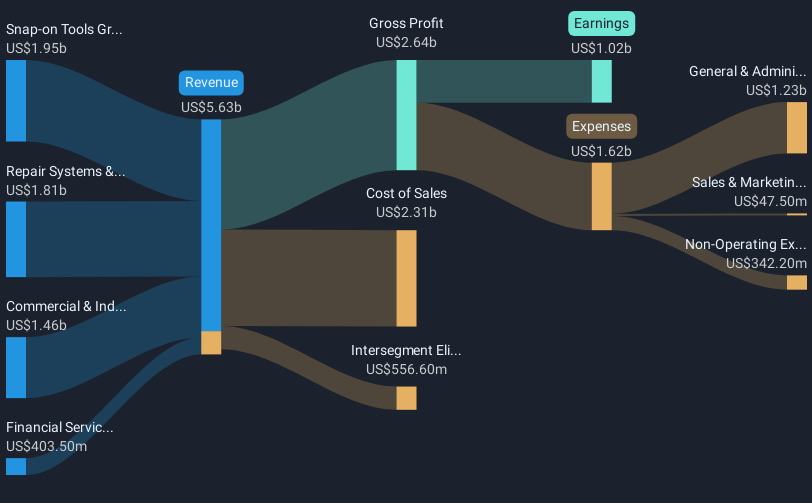

In the short term, Snap-on's share price movement aligns closely with the consensus price target of US$321.39. This close alignment indicates confidence in the company’s earnings potential. Current forecasts anticipate revenue growth of US$5.30 billion by 2028 and a slight profit margin improvement from 20.1% to 21.0%. Additionally, with earnings projected to reach approximately US$1.1 billion, the consistent dividend declaration reinforces the view of sustained profitability. However, future earnings growth will rely on advancing U.S. manufacturing capabilities and introducing innovative products to mitigate potential challenges like tariffs and global trade policy shifts.

Evaluate Snap-on's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal