12 Analysts Assess Raymond James Finl: What You Need To Know

Raymond James Finl (NYSE:RJF) has been analyzed by 12 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 7 | 0 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 3 | 0 | 0 |

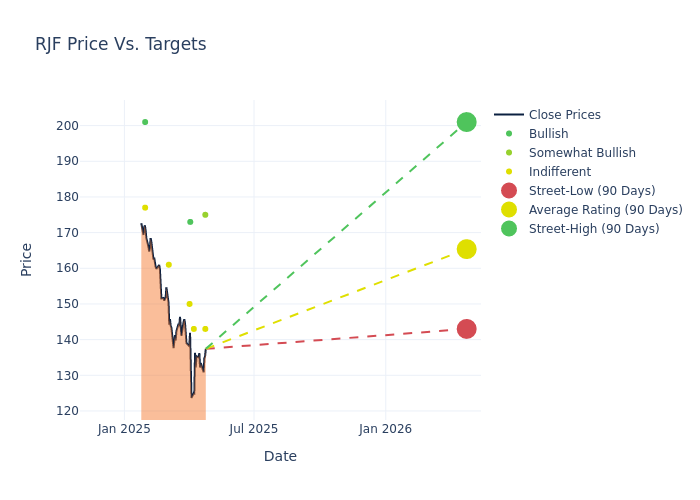

Insights from analysts' 12-month price targets are revealed, presenting an average target of $169.67, a high estimate of $201.00, and a low estimate of $143.00. A decline of 2.77% from the prior average price target is evident in the current average.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Raymond James Finl's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|-----------------------|---------------|-----------------|--------------------|--------------------| |Michael Cho |JP Morgan |Lowers |Neutral | $143.00|$149.00 | |Devin Ryan |JMP Securities |Maintains |Market Outperform| $175.00|$175.00 | |Michael Brown |Wells Fargo |Lowers |Equal-Weight | $143.00|$176.00 | |Devin Ryan |JMP Securities |Lowers |Market Outperform| $175.00|$190.00 | |Alexander Blostein |Goldman Sachs |Lowers |Buy | $173.00|$198.00 | |Christopher Allen |Citigroup |Lowers |Neutral | $150.00|$180.00 | |Michael Cyprys |Morgan Stanley |Raises |Equal-Weight | $161.00|$149.00 | |Mark McLaughlin |B of A Securities |Raises |Buy | $201.00|$198.00 | |Michael Cho |JP Morgan |Raises |Neutral | $172.00|$166.00 | |Kyle Voigt |Keefe, Bruyette & Woods|Raises |Market Perform | $177.00|$170.00 | |Devin Ryan |JMP Securities |Raises |Market Outperform| $190.00|$175.00 | |Michael Brown |Wells Fargo |Raises |Equal-Weight | $176.00|$168.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Raymond James Finl. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Raymond James Finl compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Raymond James Finl's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Raymond James Finl's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Raymond James Finl analyst ratings.

Get to Know Raymond James Finl Better

Raymond James Financial is a financial holding company whose major operations include wealth management, investment banking, asset management, and commercial banking. The company supports more than 8,000 employee and independent contractor financial advisors across the United States, Canada, and the United Kingdom with over $1.5 trillion of assets under administration as of September 2024. Approximately 90% of the company's revenue is from the US and 70% is from the company's wealth-management segment.

Raymond James Finl's Economic Impact: An Analysis

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Raymond James Finl's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 17.19%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Raymond James Finl's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 17.19%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Raymond James Finl's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 5.11%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Raymond James Finl's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.72%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Raymond James Finl's debt-to-equity ratio is below the industry average at 0.26, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal