e.l.f. Beauty (NYSE:ELF) Gains 14% In Share Price Over Last Week

e.l.f. Beauty (NYSE:ELF) saw a 14% increase in its share price over the last week, amid significant changes in its board of directors. Beth Pritchard resigned from the board, while Charles Victor Bergh, with an impressive background, joined as a new director. This leadership transition could bring fresh perspectives to the company. Meanwhile, the broader market also experienced significant growth, influenced by various factors including robust earnings reports and anticipation of changes in tariffs. The positive market sentiment likely supported ELF's price increase, complemented by the company's internal changes and potential future strategies.

e.l.f. Beauty has 2 risks we think you should know about.

This recent leadership transition at e.l.f. Beauty, featuring Charles Victor Bergh joining the board, could potentially influence the company's strategic direction, particularly with its focus on digital expansion and international markets. Over the past five years, e.l.f. Beauty's total shareholder return, including dividends, reached a very large 331.59%. In contrast to this substantial growth, the company did not perform as well over the past year compared to the US Personal Products industry, which returned -32.7%, indicating potential challenges in maintaining the pace of past performance amid current market conditions.

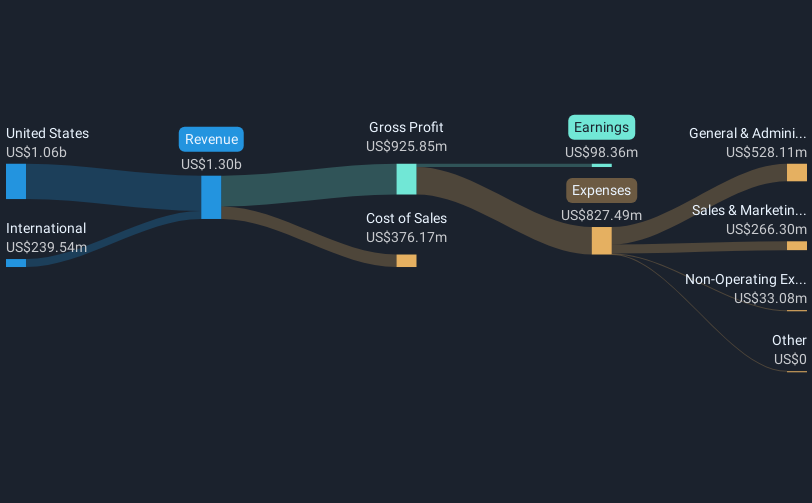

The changes in the board are expected to further support e.l.f. Beauty in enhancing its presence across digital channels and drive revenue through international expansion. Analysts forecast that revenues will continue to grow at an annual rate of 9.1%, leading to earnings of US$276.9 million by 2028, up from US$98.36 million today. However, factors like consumer consumption trends and foreign currency fluctuations could impact these forecasts. The recent increase in share price places e.l.f. Beauty at a US$55.33 valuation, offering a price target upside of approximately 33.8% relative to the consensus analyst target of US$83.63, suggesting room for growth if the company meets these future expectations.

Understand e.l.f. Beauty's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal