Norfolk Southern (NYSE:NSC) Completes Share Buyback As Q1 Earnings and Revenue Announced

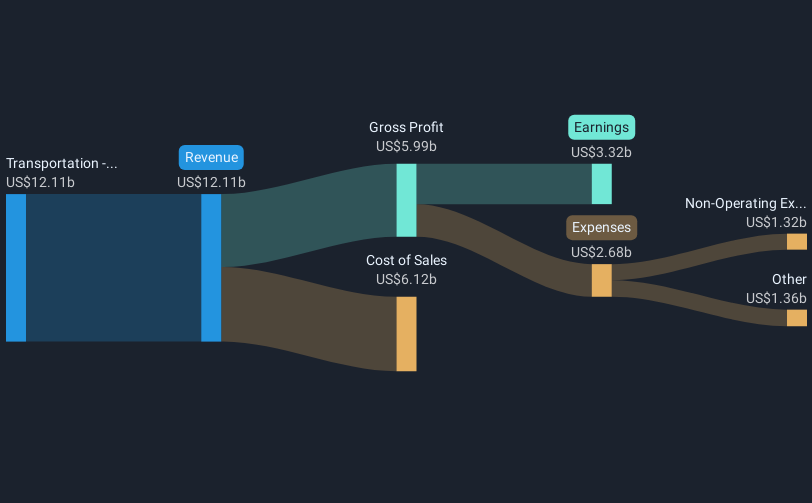

Norfolk Southern (NYSE:NSC) recently announced its first-quarter earnings showing a significant rise in net income to $750 million from $53 million the previous year, alongside affirming its quarterly dividend. Over the past week, the company's share price moved up by 4%, aligning with the market's 2% climb. The robust earnings report and ongoing share buyback program, which reduced outstanding shares by 6%, likely supported this positive momentum. While the transportation sector is generally less volatile compared to technology-driven markets, Norfolk Southern's financial strategies bolstered investor confidence amid broader market gains led by tech stocks.

We've identified 1 risk for Norfolk Southern that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent news of Norfolk Southern's robust earnings increase and ongoing share buyback program has positioned the company positively, which may further enhance investor confidence. This financial strategy aligns with their PSR 2.0 transformation initiatives aimed at boosting operational efficiencies and cost savings. The improved net income reported could potentially support future revenue and earnings forecasts by offsetting some pressures such as lower coal prices and trade policy uncertainties. The company's focus on enhancing customer confidence and capturing market share seems to be a favorable narrative for sustaining revenue growth.

Over a five-year period, Norfolk Southern's total return, including share price gains and dividends, reached 36.43%. In the past year alone, its performance exceeded the US Transportation sector, which recorded a 9.6% decline, while its one-year return of 3.6% trailed the broader US market. This underperformance relative to the market highlights the more conservative growth pace of the transportation industry. With the current share price standing at US$220.00, it trades at a 15.6% discount to the consensus analyst price target of US$260.70, suggesting room for potential appreciation if the company's initiatives continue to translate into expected financial improvements.

Review our historical performance report to gain insights into Norfolk Southern's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal