The Analyst Verdict: Fabrinet In The Eyes Of 9 Experts

In the last three months, 9 analysts have published ratings on Fabrinet (NYSE:FN), offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 2 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 2 | 0 | 0 |

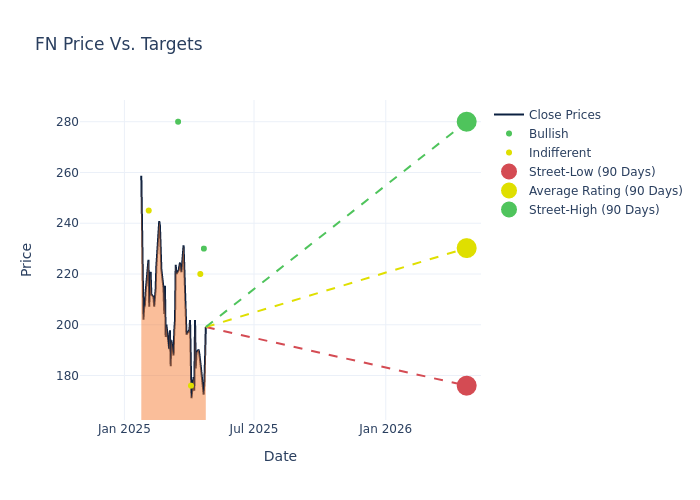

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $251.78, a high estimate of $285.00, and a low estimate of $176.00. A 6.17% drop is evident in the current average compared to the previous average price target of $268.33.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Fabrinet. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Mike Genovese |Rosenblatt |Lowers |Buy | $230.00|$280.00 | |Samik Chatterjee |JP Morgan |Lowers |Neutral | $220.00|$265.00 | |Dave Kang |B. Riley Securities |Lowers |Neutral | $176.00|$178.00 | |Ryan Koontz |Needham |Maintains |Buy | $280.00|$280.00 | |Mike Genovese |Rosenblatt |Maintains |Buy | $285.00|$285.00 | |Samik Chatterjee |JP Morgan |Lowers |Neutral | $265.00|$275.00 | |George Wang |Barclays |Lowers |Equal-Weight | $245.00|$292.00 | |Mike Genovese |Rosenblatt |Raises |Buy | $285.00|$280.00 | |Ryan Koontz |Needham |Maintains |Buy | $280.00|$280.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Fabrinet. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Fabrinet compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Fabrinet's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Fabrinet's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Fabrinet analyst ratings.

All You Need to Know About Fabrinet

Fabrinet provides advanced optical packaging and precision optical, electro-mechanical, and electronic manufacturing services to original equipment manufacturers of complex products, such as optical communication components, modules and sub-systems, industrial lasers, automotive components, medical devices, and sensors. The company offers a broad range of advanced optical and electro-mechanical capabilities across the entire manufacturing process, including process design and engineering, supply chain management, manufacturing, complex printed circuit board assembly, advanced packaging, integration, final assembly, and testing. The company generates the majority of its revenue from North America and Asia-Pacific, with the rest from Europe.

Fabrinet's Economic Impact: An Analysis

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Over the 3M period, Fabrinet showcased positive performance, achieving a revenue growth rate of 16.97% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 10.39%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Fabrinet's ROE stands out, surpassing industry averages. With an impressive ROE of 4.72%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Fabrinet's ROA excels beyond industry benchmarks, reaching 3.48%. This signifies efficient management of assets and strong financial health.

Debt Management: Fabrinet's debt-to-equity ratio is below the industry average. With a ratio of 0.0, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal