There's Reason For Concern Over Donaldson Company, Inc.'s (NYSE:DCI) Price

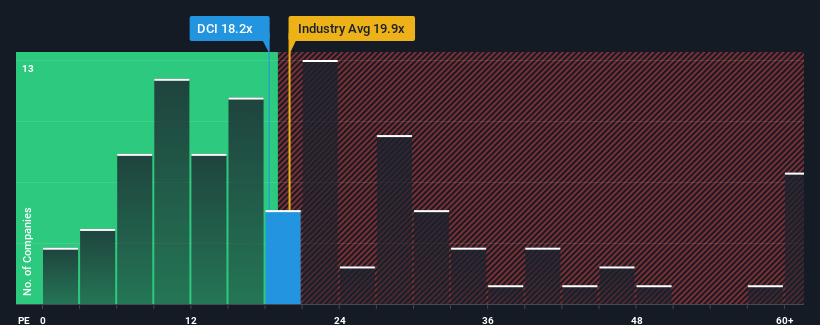

It's not a stretch to say that Donaldson Company, Inc.'s (NYSE:DCI) price-to-earnings (or "P/E") ratio of 18.2x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Donaldson Company certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Donaldson Company

Does Growth Match The P/E?

Donaldson Company's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. This was backed up an excellent period prior to see EPS up by 38% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 7.7% per year as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 10% per annum growth forecast for the broader market.

In light of this, it's curious that Donaldson Company's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Donaldson Company's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Donaldson Company with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Donaldson Company. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal