Forecasting The Future: 16 Analyst Projections For Texas Roadhouse

In the last three months, 16 analysts have published ratings on Texas Roadhouse (NASDAQ:TXRH), offering a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 10 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 3 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 2 | 1 | 5 | 0 | 0 |

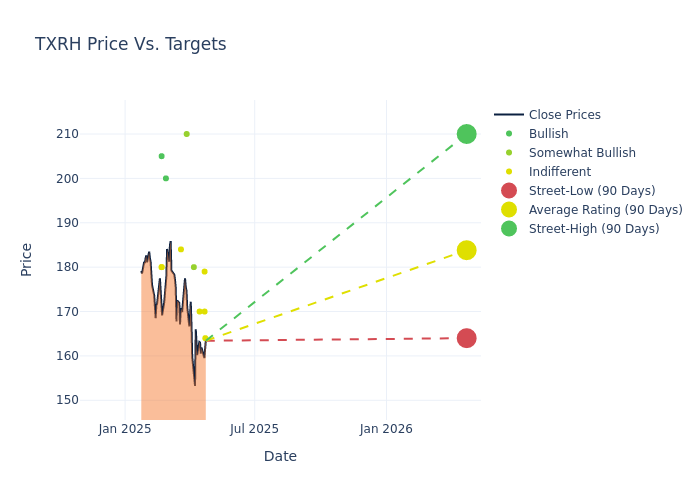

In the assessment of 12-month price targets, analysts unveil insights for Texas Roadhouse, presenting an average target of $185.62, a high estimate of $213.00, and a low estimate of $164.00. This current average has decreased by 5.02% from the previous average price target of $195.44.

Investigating Analyst Ratings: An Elaborate Study

A comprehensive examination of how financial experts perceive Texas Roadhouse is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Jon Tower |Citigroup |Lowers |Neutral | $164.00|$213.00 | |Jeffrey Bernstein |Barclays |Raises |Equal-Weight | $179.00|$178.00 | |Zachary Fadem |Wells Fargo |Lowers |Equal-Weight | $170.00|$175.00 | |Chris O'Cull |Stifel |Lowers |Hold | $170.00|$172.00 | |David Tarantino |Baird |Lowers |Outperform | $180.00|$198.00 | |Nick Setyan |Wedbush |Raises |Outperform | $210.00|$200.00 | |John Ivankoe |JP Morgan |Lowers |Neutral | $184.00|$185.00 | |Gregory Francfort |Guggenheim |Lowers |Buy | $200.00|$205.00 | |Jim Salera |Stephens & Co. |Lowers |Equal-Weight | $180.00|$186.00 | |Logan Reich |RBC Capital |Lowers |Sector Perform | $180.00|$200.00 | |Jon Tower |Citigroup |Raises |Buy | $213.00|$212.00 | |Jake Bartlett |Truist Securities |Lowers |Buy | $205.00|$209.00 | |Chris O'Cull |Stifel |Lowers |Hold | $172.00|$185.00 | |Nick Setyan |Wedbush |Lowers |Outperform | $200.00|$220.00 | |Jeffrey Bernstein |Barclays |Lowers |Equal-Weight | $178.00|$194.00 | |Chris O'Cull |Stifel |Lowers |Hold | $185.00|$195.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Texas Roadhouse. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Texas Roadhouse compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Texas Roadhouse's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Texas Roadhouse's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Texas Roadhouse analyst ratings.

Unveiling the Story Behind Texas Roadhouse

Texas Roadhouse Inc is a restaurant company operating predominantly in the casual dining segment. The company manages its restaurant and franchising operations by concept and, as a result, has identified Texas Roadhouse, Bubba's 33, Jaggers, and retail initiatives as separate operating segments. In addition, it has identified Texas Roadhouse and Bubba's 33 as reportable segments. Maximum revenue for the company is generated from the Texas Roadhouse segment, which is a moderately priced, full-service, casual dining restaurant concept offering steaks, a selection of ribs, seafood, chicken, pork chops, pulled pork, vegetable plates, and an assortment of hamburgers, salads, and sandwiches.

Financial Insights: Texas Roadhouse

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Texas Roadhouse displayed positive results in 3M. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 23.49%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Texas Roadhouse's net margin is impressive, surpassing industry averages. With a net margin of 8.06%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Texas Roadhouse's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 8.69%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Texas Roadhouse's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.79% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Texas Roadhouse's debt-to-equity ratio is below the industry average at 0.63, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal