Expert Outlook: Veritex Holdings Through The Eyes Of 6 Analysts

In the preceding three months, 6 analysts have released ratings for Veritex Holdings (NASDAQ:VBTX), presenting a wide array of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 1 | 0 | 0 |

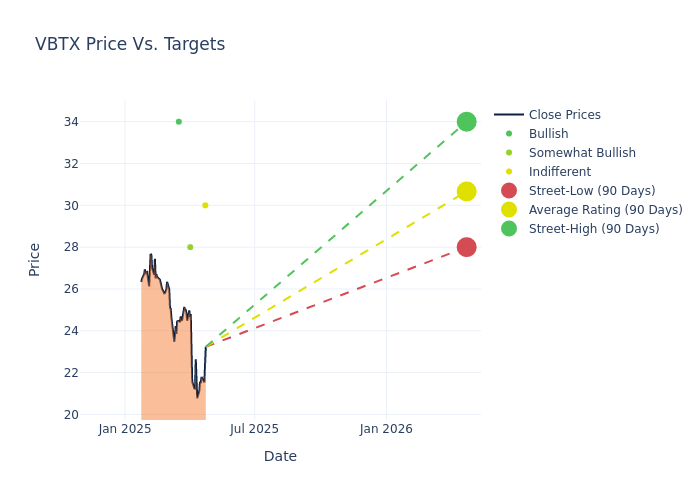

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $31.33, a high estimate of $34.00, and a low estimate of $28.00. This current average represents a 4.57% decrease from the previous average price target of $32.83.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Veritex Holdings among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Matt Olney |Stephens & Co. |Maintains |Equal-Weight | $30.00|$30.00 | |Michael Rose |Raymond James |Lowers |Outperform | $28.00|$31.00 | |Gary Tenner |DA Davidson |Maintains |Buy | $34.00|$34.00 | |Gary Tenner |DA Davidson |Lowers |Buy | $34.00|$36.00 | |Matt Olney |Stephens & Co. |Lowers |Equal-Weight | $31.00|$34.00 | |Michael Rose |Raymond James |Lowers |Strong Buy | $31.00|$32.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Veritex Holdings. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Veritex Holdings compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Veritex Holdings's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of Veritex Holdings's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Veritex Holdings analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind Veritex Holdings

Veritex Holdings Inc is engaged in the provision of commercial banking products and services to small to medium-sized businesses and professionals. The bank provides a range of banking services to individual and corporate customers, which include commercial and retail lending, and the acceptance of checking and savings deposits. It offers a suite of online banking solutions, including access to account balances, online transfers, online bill payment and electronic delivery of customer statements, as well as automated teller machines, and banking by telephone, mail and personal appointment. The company's primary sources of revenue are derived from interest and dividends earned on loans, debt and equity securities and other financial instruments.

Veritex Holdings's Economic Impact: An Analysis

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Veritex Holdings's revenue growth over a period of 3M has faced challenges. As of 31 December, 2024, the company experienced a revenue decline of approximately -0.9%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Veritex Holdings's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 23.43% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Veritex Holdings's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.55%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Veritex Holdings's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.19%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.14.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal