Demystifying Equifax: Insights From 10 Analyst Reviews

During the last three months, 10 analysts shared their evaluations of Equifax (NYSE:EFX), revealing diverse outlooks from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 5 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 4 | 0 | 0 | 0 |

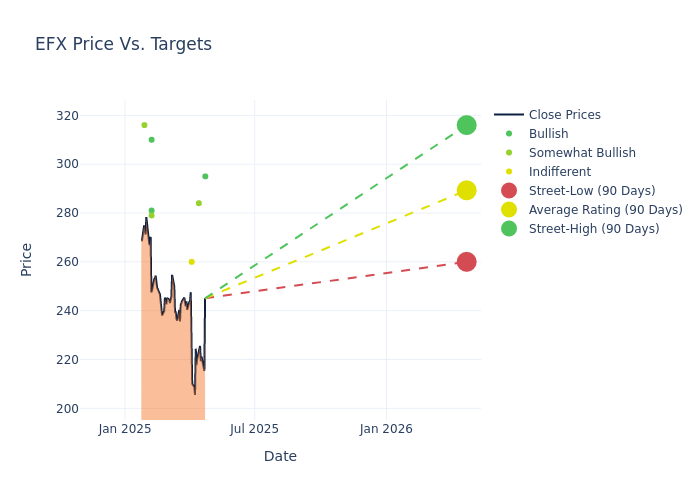

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $296.3, a high estimate of $325.00, and a low estimate of $260.00. This current average represents a 5.61% decrease from the previous average price target of $313.90.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of Equifax by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Kyle Peterson |Needham |Maintains |Buy | $295.00|$295.00 | |Jason Haas |Wells Fargo |Lowers |Overweight | $284.00|$313.00 | |Manav Patnaik |Barclays |Lowers |Equal-Weight | $260.00|$325.00 | |Manav Patnaik |Barclays |Lowers |Overweight | $325.00|$335.00 | |Owen Lau |Oppenheimer |Lowers |Outperform | $279.00|$286.00 | |Kevin Mcveigh |UBS |Lowers |Buy | $310.00|$335.00 | |Shlomo Rosenbaum |Stifel |Lowers |Buy | $281.00|$284.00 | |Kyle Peterson |Needham |Lowers |Buy | $300.00|$325.00 | |Jason Haas |Wells Fargo |Lowers |Overweight | $313.00|$321.00 | |Toni Kaplan |Morgan Stanley |Lowers |Overweight | $316.00|$320.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Equifax. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Equifax compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Equifax's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Equifax's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Equifax analyst ratings.

About Equifax

Along with Experian and TransUnion, Equifax is one of the leading credit bureaus in the United States. Equifax's credit reports provide credit histories on millions of consumers, and the firm's services are critical to lenders' credit decisions. In addition, over 40% of the firm's revenue comes from workforce solutions, which provides income verification and employer human resources services. Equifax generates just over 20% of its revenue from outside the United States.

Financial Insights: Equifax

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Equifax's revenue growth over a period of 3M has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 7.0%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Equifax's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 12.26%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Equifax's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.59%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 1.44%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Equifax's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.04.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal