April 2025's Promising Penny Stocks To Watch

Over the last 7 days, the U.S. market has dropped 1.7%, though it has risen by 3.6% over the past year, with earnings projected to grow by 13% annually in the coming years. In light of these conditions, identifying stocks with strong financials is crucial for investors seeking opportunities in smaller or newer companies often associated with penny stocks—a term that might seem outdated but remains relevant for its potential value and growth prospects. This article will explore several penny stocks that demonstrate financial strength and could be promising candidates for those looking to invest in under-the-radar companies poised for future success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.21 | $337.6M | ✅ 4 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $1.99 | $1.12B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $1.05 | $15.82M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.02 | $8.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.77 | $47.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.59 | $77.04M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.79 | $5.74M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $198.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.82 | $84M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.4827 | $15.22M | ✅ 3 ⚠️ 5 View Analysis > |

Click here to see the full list of 778 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Grab Holdings (NasdaqGS:GRAB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grab Holdings Limited operates as a superapp provider across Southeast Asia, offering various services such as transportation, food delivery, and digital payments in countries including Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. It has a market cap of approximately $16.57 billion.

Operations: The company's revenue segments include Mobility ($1.05 billion), Deliveries ($1.49 billion), and Financial Services ($253 million).

Market Cap: $16.57B

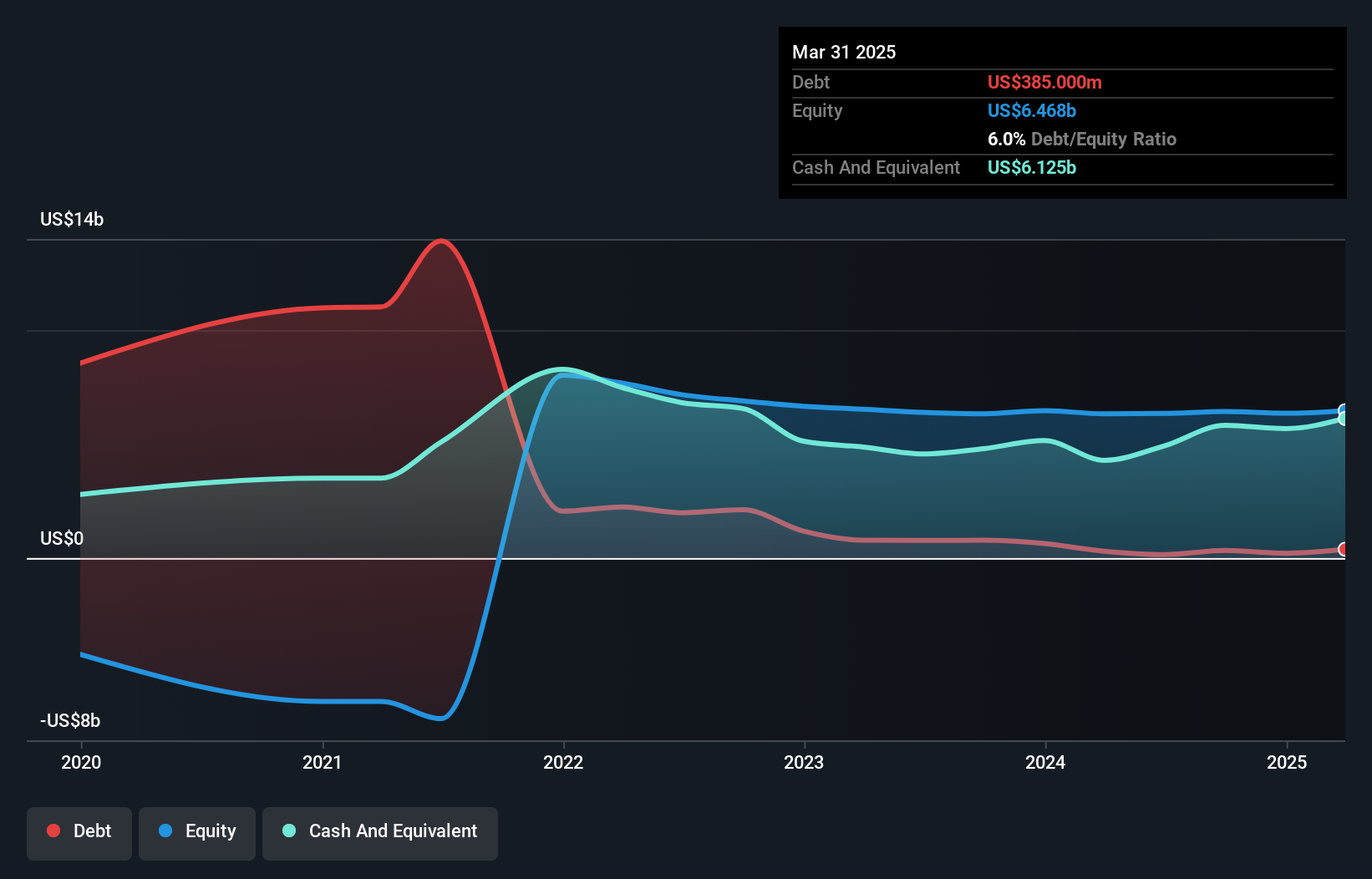

Grab Holdings, with a market cap of US$16.57 billion, is unprofitable but has improved its financial position by reducing losses at an annual rate of 45.2% over the past five years. The company maintains a positive cash flow and sufficient cash runway for over three years, supported by short-term assets exceeding both short and long-term liabilities. Recent developments include being added to the NASDAQ Internet Index and ongoing merger discussions with GoTo Group, though no transaction is confirmed yet. Analysts expect earnings growth of 41.67% annually, while shares trade below estimated fair value despite stable volatility.

- Navigate through the intricacies of Grab Holdings with our comprehensive balance sheet health report here.

- Examine Grab Holdings' earnings growth report to understand how analysts expect it to perform.

Opendoor Technologies (NasdaqGS:OPEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Opendoor Technologies Inc. operates a digital platform for residential real estate transactions in the United States, with a market cap of approximately $674.90 million.

Operations: The company generates revenue primarily from its real estate brokerage activities, amounting to $5.15 billion.

Market Cap: $674.9M

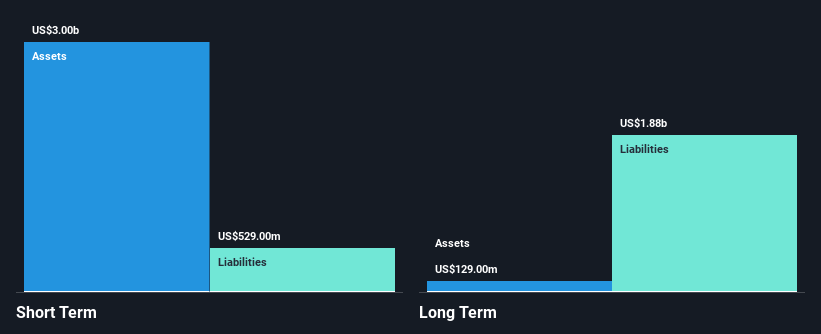

Opendoor Technologies, with a market cap of approximately US$674.90 million, remains unprofitable and is not expected to achieve profitability in the next three years. Despite generating significant revenue of US$5.15 billion primarily from real estate brokerage activities, the company faces challenges such as a high net debt to equity ratio of 227.6% and increasing losses over the past five years at 9.8% annually. However, Opendoor's short-term assets exceed both its short and long-term liabilities, providing financial stability alongside a sufficient cash runway for over three years if free cash flow continues growing historically at 14.4%. Recent earnings show increased sales but also larger net losses year-over-year.

- Take a closer look at Opendoor Technologies' potential here in our financial health report.

- Gain insights into Opendoor Technologies' outlook and expected performance with our report on the company's earnings estimates.

Vimeo (NasdaqGS:VMEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vimeo, Inc. offers video software solutions both in the United States and internationally, with a market cap of approximately $797.88 million.

Operations: The company generates revenue of $417.01 million from its Internet Software & Services segment.

Market Cap: $797.88M

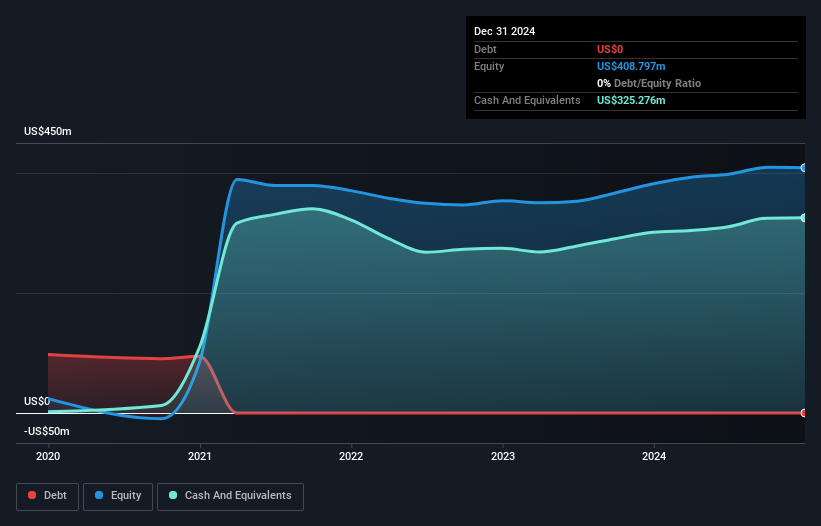

Vimeo, Inc., with a market cap of US$797.88 million, shows promise in the penny stock realm due to its strong financial health and innovative strategies. The company generates substantial revenue of US$417.01 million from its Internet Software & Services segment and has maintained high-quality earnings with improved profit margins over the past year. Vimeo's recent launch of Vimeo Streaming introduces new monetization tools and advanced analytics, enhancing creator engagement and revenue potential. Despite an operating loss forecast for 2025, Vimeo remains debt-free, with short-term assets exceeding liabilities, providing a stable financial foundation amidst industry challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Vimeo.

- Assess Vimeo's future earnings estimates with our detailed growth reports.

Make It Happen

- Embark on your investment journey to our 778 US Penny Stocks selection here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal